US Automotive Wheel Coating Market Summary

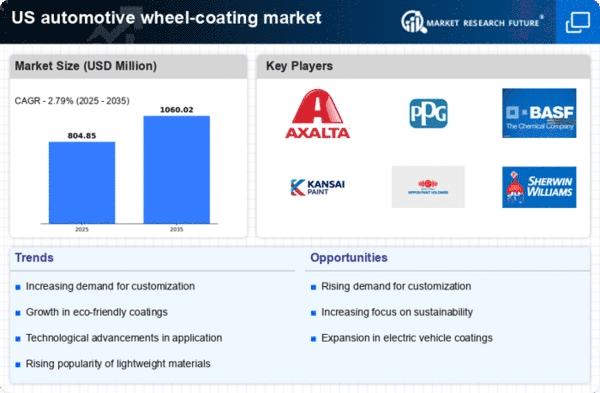

As per Market Research Future analysis, the US automotive wheel-coating market size was estimated at 783.0 USD Million in 2024. The US automotive wheel-coating market is projected to grow from 804.85 USD Million in 2025 to 1060.02 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 2.7% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US automotive wheel-coating market is experiencing a dynamic shift towards innovative and sustainable solutions.

- Technological advancements in coatings are enhancing performance and durability, appealing to consumers.

- There is a notable shift towards eco-friendly products, reflecting growing environmental awareness among consumers.

- Customization and aesthetic appeal are driving demand, particularly in the aftermarket segment.

- Rising demand for vehicle customization and increased focus on durability and performance are key market drivers.

Market Size & Forecast

| 2024 Market Size | 783.0 (USD Million) |

| 2035 Market Size | 1060.02 (USD Million) |

| CAGR (2025 - 2035) | 2.79% |

Major Players

Axalta Coating Systems (US), PPG Industries (US), BASF SE (DE), Kansai Paint Co Ltd (JP), Nippon Paint Holdings Co Ltd (JP), Sherwin-Williams Company (US), 3M Company (US), Hempel A/S (DK)