Regulatory Standards

Regulatory compliance is a significant driver influencing the Automotive Horns And Fanfares Market. Governments worldwide are implementing stringent noise regulations to mitigate sound pollution, which directly impacts the design and functionality of automotive horns. Manufacturers must adapt their products to meet these evolving standards, often leading to the development of quieter, yet effective, horn systems. This regulatory landscape not only compels manufacturers to innovate but also creates opportunities for those who can effectively balance compliance with performance. As regulations become more rigorous, the Automotive Horns And Fanfares Market is likely to experience a shift towards more environmentally friendly solutions.

Rising Vehicle Production

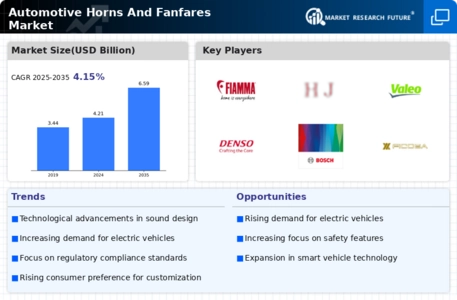

The increasing production of vehicles is a primary driver for the Automotive Horns And Fanfares Market. As manufacturers ramp up output to meet consumer demand, the need for automotive horns and fanfares rises correspondingly. In recent years, vehicle production has shown a steady upward trend, with millions of units produced annually. This surge in production not only boosts the demand for horns but also encourages innovation in design and functionality. Manufacturers are likely to invest in advanced horn technologies to enhance sound quality and durability, thereby expanding their market share. Consequently, the Automotive Horns And Fanfares Market is poised for growth as vehicle production continues to escalate.

Technological Innovations

Technological advancements play a crucial role in shaping the Automotive Horns And Fanfares Market. Innovations such as electronic horns and multi-tone systems are gaining traction, offering improved sound quality and customization options. These advancements not only enhance the auditory experience but also align with the growing consumer preference for unique vehicle features. The integration of smart technologies, such as connectivity with vehicle systems, is also emerging. As manufacturers adopt these innovations, the market is likely to witness a shift towards more sophisticated horn systems, potentially increasing their market value. The Automotive Horns And Fanfares Market appears to be on the brink of a technological revolution.

Expansion of Electric Vehicles

The rise of electric vehicles (EVs) is emerging as a pivotal driver for the Automotive Horns And Fanfares Market. As the automotive landscape shifts towards electrification, the demand for specialized horn systems that comply with safety regulations for silent vehicles is increasing. EVs require sound-emitting devices to alert pedestrians, creating a new market segment for innovative horn solutions. This transition not only presents challenges but also opportunities for manufacturers to develop unique products tailored for electric models. The Automotive Horns And Fanfares Market is expected to evolve significantly as it adapts to the growing presence of electric vehicles.

Consumer Demand for Customization

The growing consumer demand for vehicle personalization is significantly influencing the Automotive Horns And Fanfares Market. As consumers seek to differentiate their vehicles, the desire for unique horn sounds and designs has increased. This trend encourages manufacturers to offer customizable options, allowing consumers to select horn tones that reflect their personal style. Market data indicates that a substantial segment of consumers is willing to pay a premium for customized features, which could lead to increased revenue for manufacturers. Consequently, the Automotive Horns And Fanfares Market is likely to expand as companies respond to this demand for individuality.