Stringent Emission Regulations

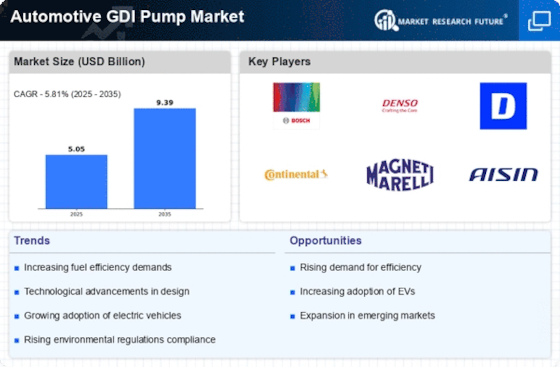

The Automotive GDI Pump Market is significantly influenced by stringent emission regulations imposed by various governments. These regulations aim to reduce harmful emissions from vehicles, pushing manufacturers to adopt advanced technologies that comply with environmental standards. GDI systems, known for their ability to minimize particulate emissions and enhance combustion efficiency, are increasingly favored in this context. As a result, the demand for GDI pumps is expected to rise, as they are integral to meeting these regulatory requirements. The Automotive GDI Pump Market is projected to grow as manufacturers invest in cleaner technologies to align with evolving legislation and consumer preferences for environmentally friendly vehicles.

Rising Demand for Fuel Efficiency

The Automotive GDI Pump Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become increasingly conscious of fuel costs and environmental impacts, automakers are compelled to enhance fuel efficiency in their offerings. GDI pumps play a crucial role in achieving this goal by delivering precise fuel injection, which optimizes combustion and reduces fuel consumption. According to recent data, vehicles equipped with GDI technology can achieve fuel efficiency improvements of up to 15% compared to traditional systems. This trend is likely to drive the Automotive GDI Pump Market as manufacturers seek to meet regulatory standards and consumer expectations for lower emissions and better mileage.

Growth of Electric and Hybrid Vehicles

The Automotive GDI Pump Market is also impacted by the growth of electric and hybrid vehicles. While these vehicles primarily rely on electric power, many hybrid models still utilize internal combustion engines that benefit from GDI technology. As the market for hybrid vehicles expands, the demand for GDI pumps is expected to persist, albeit in a different capacity. The Automotive GDI Pump Market may see a shift in focus towards developing pumps that can efficiently operate in conjunction with electric drivetrains, ensuring optimal performance and fuel efficiency. This transition presents both challenges and opportunities for manufacturers in the evolving automotive landscape.

Technological Innovations in Fuel Injection Systems

Technological innovations in fuel injection systems are propelling the Automotive GDI Pump Market forward. Advances in materials, design, and electronic control systems have led to the development of more efficient and reliable GDI pumps. These innovations not only enhance performance but also contribute to reduced emissions and improved fuel economy. For instance, the integration of advanced sensors and control algorithms allows for precise fuel delivery, optimizing engine performance under various conditions. As automakers continue to invest in research and development, the Automotive GDI Pump Market is likely to witness a surge in demand for these cutting-edge technologies, further driving market growth.

Increasing Consumer Preference for Performance Vehicles

The Automotive GDI Pump Market is witnessing an increase in consumer preference for performance-oriented vehicles. Enthusiasts and everyday drivers alike are seeking vehicles that offer enhanced power and responsiveness, which GDI technology can provide. By delivering fuel directly into the combustion chamber at high pressure, GDI pumps enable more efficient combustion, resulting in improved engine performance. This trend is reflected in the growing popularity of sports cars and high-performance models that utilize GDI systems. As automakers respond to this demand, the Automotive GDI Pump Market is likely to experience growth driven by the need for advanced fuel delivery systems that cater to performance-focused consumers.