Growth of the Aftermarket Segment

The Automotive GD Injector Market is witnessing a robust expansion in the aftermarket segment. As vehicle ownership increases, the demand for replacement parts, including GD injectors, is also on the rise. Consumers are increasingly opting for aftermarket solutions to enhance vehicle performance and efficiency. This trend is supported by the growing awareness of the benefits of high-quality GD injectors, which can significantly improve engine performance and fuel economy. Market data suggests that the aftermarket for automotive components is expected to grow at a compound annual growth rate of over 5% in the coming years. Consequently, the Automotive GD Injector Market is likely to benefit from this trend, as manufacturers and suppliers focus on providing high-performance aftermarket solutions.

Rising Demand for Fuel Efficiency

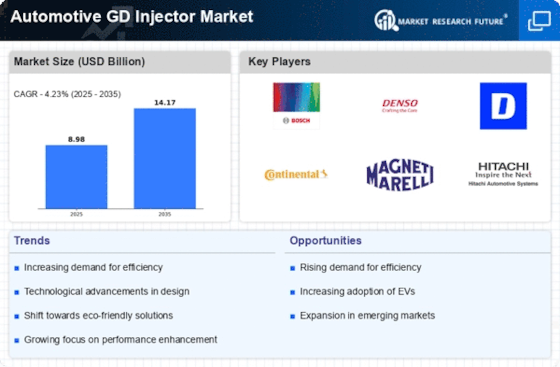

The Automotive GD Injector Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become increasingly conscious of fuel costs and environmental impacts, manufacturers are compelled to innovate. The integration of advanced GD injectors enhances combustion efficiency, thereby improving fuel economy. According to recent data, vehicles equipped with high-performance GD injectors can achieve fuel savings of up to 15% compared to traditional systems. This trend is likely to drive the market as automakers strive to meet consumer expectations while adhering to stringent fuel efficiency standards. Consequently, the Automotive GD Injector Market is poised for growth as it aligns with the broader shift towards sustainable automotive solutions.

Increasing Vehicle Production and Sales

The Automotive GD Injector Market is significantly influenced by the rising production and sales of vehicles worldwide. As economies recover and consumer confidence grows, the automotive sector is witnessing a resurgence. Data indicates that vehicle production is projected to reach over 100 million units annually by 2026, creating a substantial demand for GD injectors. This increase in vehicle output is driven by both traditional internal combustion engine vehicles and the growing segment of hybrid models. Consequently, the Automotive GD Injector Market is expected to expand in tandem with this production boom, as manufacturers seek to equip their vehicles with advanced injection systems to enhance performance and meet regulatory standards.

Regulatory Pressures for Emission Reductions

The Automotive GD Injector Market is under significant pressure due to stringent regulatory frameworks aimed at reducing vehicle emissions. Governments worldwide are implementing more rigorous standards to combat air pollution and climate change. This regulatory environment compels manufacturers to adopt advanced GD injector technologies that can minimize emissions while maintaining performance. The market is likely to see increased investment in research and development as companies strive to comply with these regulations. Furthermore, the Automotive GD Injector Market may experience growth as manufacturers seek to differentiate their products through enhanced environmental performance, thereby appealing to environmentally conscious consumers.

Technological Innovations in Injection Systems

Technological advancements play a pivotal role in shaping the Automotive GD Injector Market. Innovations such as direct fuel injection and multi-hole nozzle designs are enhancing the performance and efficiency of GD injectors. These technologies allow for better atomization of fuel, leading to improved combustion and reduced emissions. The market is witnessing a shift towards smart injectors that can adapt to varying engine conditions, optimizing performance in real-time. As a result, manufacturers are investing heavily in research and development to stay competitive. The Automotive GD Injector Market is likely to benefit from these innovations, as they not only improve vehicle performance but also contribute to compliance with increasingly stringent emission regulations.