Rising Vehicle Production

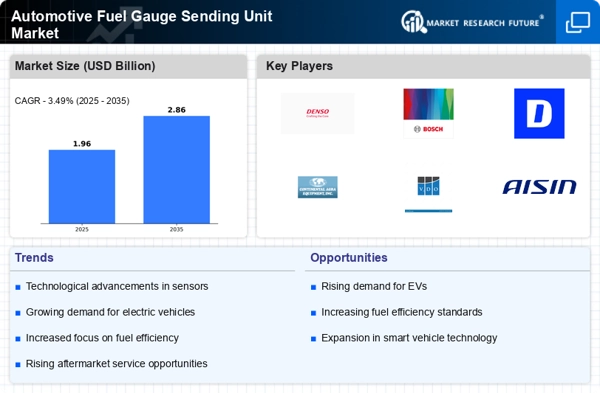

The increasing production of vehicles is a primary driver for the Automotive Fuel Gauge Sending Unit Market. As manufacturers ramp up output to meet consumer demand, the need for reliable fuel gauge systems becomes paramount. In 2025, vehicle production is projected to reach approximately 90 million units, which directly correlates with the demand for fuel gauge sending units. This surge in production not only enhances the market for these components but also encourages innovation in design and functionality. As automakers strive for efficiency and accuracy in fuel measurement, the Automotive Fuel Gauge Sending Unit Market is likely to experience substantial growth. Furthermore, the integration of advanced technologies in vehicle manufacturing may lead to the development of more sophisticated fuel gauge systems, further propelling market expansion.

Growing Demand for Fuel Efficiency

The increasing demand for fuel efficiency among consumers is a crucial driver for the Automotive Fuel Gauge Sending Unit Market. As fuel prices fluctuate and environmental concerns rise, consumers are seeking vehicles that optimize fuel consumption. This trend has led manufacturers to focus on developing more precise fuel gauge systems that provide accurate readings, thereby assisting drivers in managing fuel usage effectively. In 2025, the fuel-efficient vehicle market is expected to grow significantly, with a projected increase in hybrid and electric vehicle sales. This shift towards fuel-efficient vehicles is likely to create a corresponding demand for advanced fuel gauge sending units, positioning the Automotive Fuel Gauge Sending Unit Market for substantial growth in the coming years.

Increased Focus on Safety Features

The heightened emphasis on safety features in vehicles significantly influences the Automotive Fuel Gauge Sending Unit Market. Consumers are increasingly prioritizing safety, prompting manufacturers to incorporate advanced fuel gauge systems that provide accurate readings and prevent fuel-related accidents. In 2025, it is estimated that the automotive safety market will exceed 200 billion USD, with a notable portion allocated to fuel management systems. This trend indicates a growing recognition of the importance of reliable fuel gauge sending units in enhancing overall vehicle safety. As automakers respond to consumer preferences and regulatory pressures, the Automotive Fuel Gauge Sending Unit Market is expected to benefit from innovations aimed at improving safety and reliability in fuel measurement.

Regulatory Standards and Compliance

The implementation of stringent regulatory standards regarding vehicle emissions and fuel efficiency is a driving force in the Automotive Fuel Gauge Sending Unit Market. Governments worldwide are enacting regulations that require manufacturers to enhance the accuracy and reliability of fuel gauge systems. In 2025, compliance with these regulations is expected to become increasingly critical, as non-compliance could result in significant penalties for manufacturers. This regulatory landscape encourages innovation and investment in fuel gauge technology, as companies strive to meet or exceed these standards. As a result, the Automotive Fuel Gauge Sending Unit Market is likely to see growth driven by the need for compliance with evolving regulations, fostering advancements in fuel gauge sending unit design and functionality.

Technological Integration in Automotive Systems

The integration of advanced technologies in automotive systems is a significant driver for the Automotive Fuel Gauge Sending Unit Market. Innovations such as digital displays, IoT connectivity, and real-time monitoring are transforming traditional fuel gauge systems into sophisticated units that enhance user experience. In 2025, the market for connected vehicles is projected to reach 50 billion USD, indicating a strong demand for technologically advanced components, including fuel gauge sending units. This trend suggests that manufacturers are likely to invest in research and development to create more efficient and accurate fuel measurement systems. Consequently, the Automotive Fuel Gauge Sending Unit Market is poised for growth as it adapts to the evolving technological landscape in the automotive sector.