Market Share

Automotive Front end Module Market Share Analysis

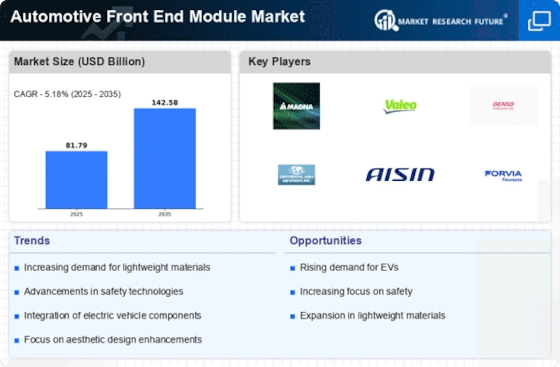

In the fiercely competitive landscape of the Automotive Front End Module (FEM) market, market share positioning strategies are crucial for manufacturers aiming to establish and maintain a strong foothold. One primary strategy revolves around product differentiation. Companies strive to distinguish their FEM offerings by incorporating unique features, advanced technologies, and innovative designs. By providing something distinctive, manufacturers can attract customers seeking specific functionalities or aesthetic elements, thereby gaining a competitive edge and a larger market share. Collaborations and strategic partnerships are another key aspect of market share positioning. Companies often form alliances with other players in the automotive ecosystem, including original equipment manufacturers (OEMs), suppliers, and technology providers. These partnerships enable access to complementary resources, expertise, and technologies, fostering an environment of mutual benefit. Such collaborations can enhance the overall value proposition of the FEMs, making them more appealing to a broader customer base and contributing to an increased market share. Pricing strategies play a pivotal role in market share positioning. Setting competitive and attractive prices is essential for capturing market share, especially in price-sensitive segments. Manufacturers may adopt penetration pricing strategies to enter new markets or gain a larger share in existing ones. Alternatively, premium pricing can be employed for FEMs with advanced features and superior performance, targeting customers who prioritize quality over cost. Striking the right balance between pricing and perceived value is critical for market share growth. Geographical expansion is a common strategy employed by FEM manufacturers to increase market share. By entering new regions or strengthening their presence in existing markets, companies can tap into diverse customer bases and respond to regional trends and preferences. Understanding the unique demands of different markets allows manufacturers to tailor their FEM offerings to suit local requirements, gaining acceptance and market share in various geographical locations. Innovation and continuous product development contribute significantly to market share positioning in the Automotive Front End Module market. Companies that invest in research and development to stay ahead of technological trends can introduce cutting-edge FEMs that cater to evolving customer needs. Whether it's integrating smart features, enhancing safety technologies, or improving energy efficiency, innovation serves as a powerful driver for capturing market share by offering products that outperform competitors. Effective marketing and brand positioning also play a vital role in market share strategies. Building a strong brand image, communicating the unique selling propositions of FEMs, and creating awareness among target customers are essential components. Customer-centric strategies focus on understanding and fulfilling the specific needs of target customers. This involves conducting market research to identify customer preferences, pain points, and emerging trends. By aligning FEM offerings with customer expectations, manufacturers can build loyalty, enhance customer satisfaction, and secure a more significant share of the market. This customer-centric approach involves continuous feedback mechanisms to adapt products and strategies in response to changing customer preferences. Global economic conditions also significantly impact the Automotive Front End Module market. Economic stability and growth contribute to increased consumer spending power, positively influencing the sales of automobiles. In times of economic prosperity, consumers are more inclined to invest in vehicles equipped with advanced features, including cutting-edge front end modules. On the other hand, economic downturns may lead to a temporary decline in automotive sales, affecting the FEM market. This sensitivity to economic fluctuations underscores the market's susceptibility to broader financial conditions. Technological advancements play a pivotal role in shaping the Automotive Front End Module market. As technology continues to advance, FEM manufacturers are incorporating state-of-the-art materials and production techniques to enhance the performance and durability of their products. The integration of sensors, adaptive lighting systems, and other smart features further propels the market forward. Automotive companies are also focusing on lightweight materials to improve fuel efficiency, and this trend has a direct impact on the design and composition of front end modules.

Leave a Comment