Market Growth Projections

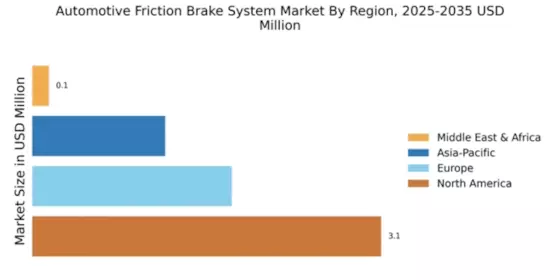

The Global Automotive Friction Brakes System Market Industry is poised for substantial growth, with projections indicating a market size of 59315.5 USD Million by 2035. This growth trajectory suggests a robust demand for innovative braking solutions, driven by advancements in technology and increasing vehicle production. The anticipated compound annual growth rate of 100.57% from 2025 to 2035 underscores the dynamic nature of this market, highlighting the potential for significant investment and development in automotive braking systems.

Increasing Vehicle Production

The Global Automotive Friction Brakes System Market Industry is closely tied to the rising production of vehicles worldwide. As automotive manufacturers ramp up production to meet consumer demand, the need for reliable braking systems becomes paramount. This trend is particularly evident in emerging markets, where vehicle ownership is on the rise. The projected growth in vehicle production is expected to drive the demand for friction brake systems, contributing to a market valuation of 59315.5 USD Million by 2035. This increase highlights the essential role of braking systems in ensuring vehicle safety and performance.

Growing Demand for Electric Vehicles

The Global Automotive Friction Brakes System Market Industry is experiencing a paradigm shift with the growing demand for electric vehicles (EVs). As the automotive landscape evolves, the braking systems in EVs require specialized designs to accommodate unique performance characteristics. This shift presents opportunities for manufacturers to innovate and develop braking solutions tailored for electric drivetrains. The increasing adoption of EVs is likely to contribute to the overall market growth, as these vehicles often require advanced braking technologies to enhance efficiency and safety, further expanding the market's potential.

Regulatory Compliance and Safety Standards

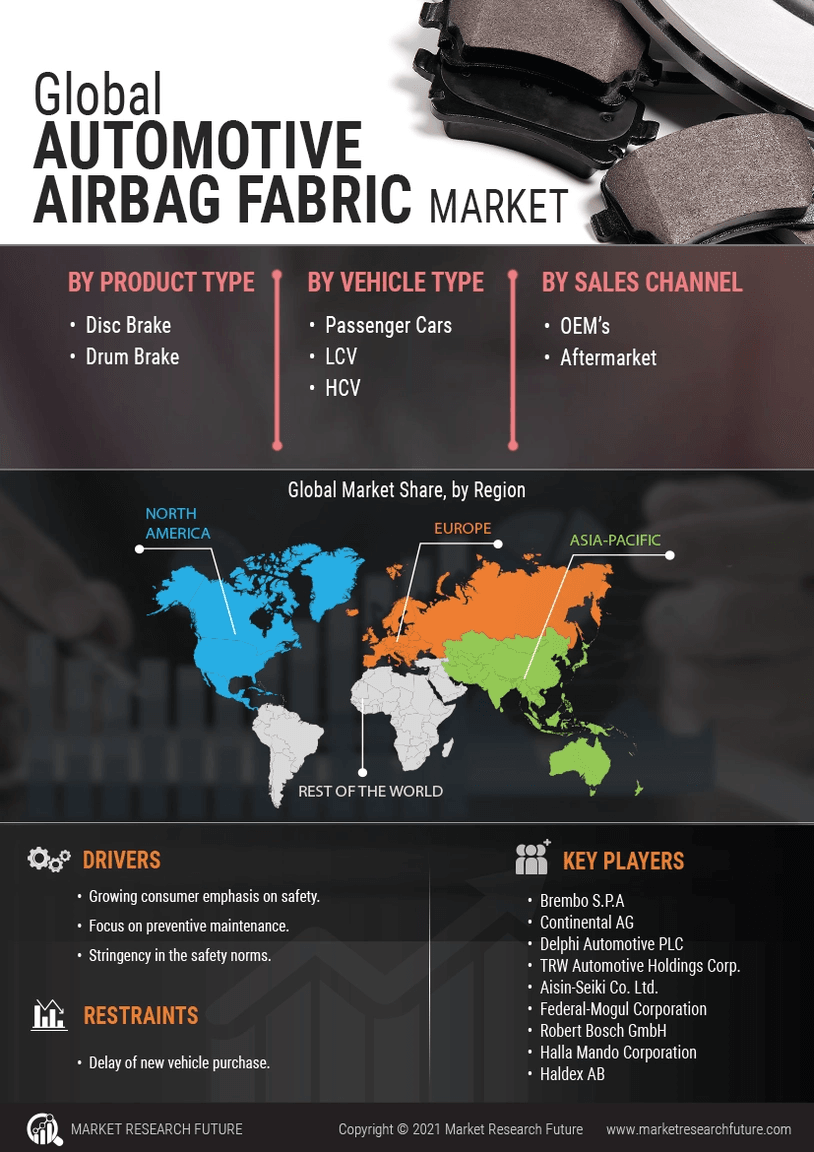

The Global Automotive Friction Brakes System Market Industry is significantly influenced by stringent regulatory compliance and safety standards. Governments worldwide are implementing rigorous regulations to enhance vehicle safety, which directly impacts the design and manufacturing of braking systems. Compliance with these standards necessitates the adoption of advanced technologies and materials, thereby driving innovation in the market. As a result, manufacturers are compelled to invest in research and development to meet these requirements, fostering a competitive landscape that could lead to a compound annual growth rate of 100.57% from 2025 to 2035.

Technological Advancements in Brake Systems

The Global Automotive Friction Brakes System Market Industry is witnessing rapid technological advancements, particularly in materials and design. Innovations such as carbon-ceramic brakes and advanced composites are enhancing performance and durability. These developments not only improve braking efficiency but also contribute to weight reduction, which is crucial for fuel efficiency. As manufacturers increasingly adopt these technologies, the market is expected to grow significantly. In 2024, the market is projected to reach 28.1 USD Million, indicating a robust demand for high-performance braking systems that meet stringent safety standards.

Consumer Awareness and Demand for Safety Features

The Global Automotive Friction Brakes System Market Industry is being propelled by heightened consumer awareness regarding vehicle safety features. As consumers become more informed about the importance of braking systems, there is a growing demand for advanced safety technologies, including anti-lock braking systems and electronic stability control. This trend is influencing manufacturers to prioritize the development of high-quality friction brake systems that meet consumer expectations. The increasing focus on safety is expected to drive market growth, as consumers are willing to invest in vehicles equipped with superior braking technologies.