Rising Vehicle Production

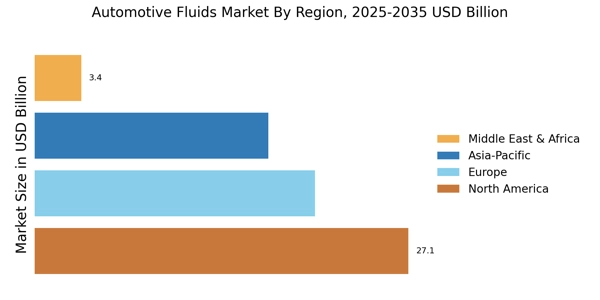

The automotive fluids market is experiencing a notable surge due to the increasing production of vehicles worldwide. As manufacturers ramp up their output to meet consumer demand, the need for various automotive fluids, including engine oils, transmission fluids, and coolants, escalates. In 2025, the production of passenger cars is projected to reach approximately 80 million units, which directly correlates with the demand for automotive fluids. This growth is further fueled by the expansion of automotive manufacturing in emerging markets, where infrastructure development and rising disposable incomes are driving vehicle ownership. Consequently, the automotive fluids market is poised for substantial growth as it adapts to the evolving needs of a burgeoning automotive sector.

Expansion of Electric Vehicle Market

The expansion of the electric vehicle market is poised to impact the automotive fluids market in various ways. While electric vehicles require fewer fluids compared to traditional internal combustion engine vehicles, the demand for specialized fluids, such as cooling agents for battery systems, is on the rise. As the electric vehicle market continues to grow, projected to reach over 30 million units by 2025, the automotive fluids market must adapt to these new requirements. This transition presents both challenges and opportunities, as manufacturers explore innovative fluid solutions tailored for electric vehicles. Consequently, the automotive fluids market is likely to evolve, reflecting the changing landscape of vehicle technology.

Growing Awareness of Vehicle Maintenance

The automotive fluids market is benefiting from a growing awareness of vehicle maintenance among consumers. As vehicle owners become more informed about the importance of regular maintenance, the demand for high-quality automotive fluids is likely to increase. This trend is particularly evident in regions where vehicle ownership is on the rise, leading to a greater emphasis on maintaining optimal vehicle performance. In 2025, it is estimated that the aftermarket for automotive fluids will account for a significant portion of the overall market, driven by consumers seeking to prolong the lifespan of their vehicles. This heightened focus on maintenance is expected to bolster the automotive fluids market as consumers prioritize quality and reliability.

Technological Advancements in Fluid Formulation

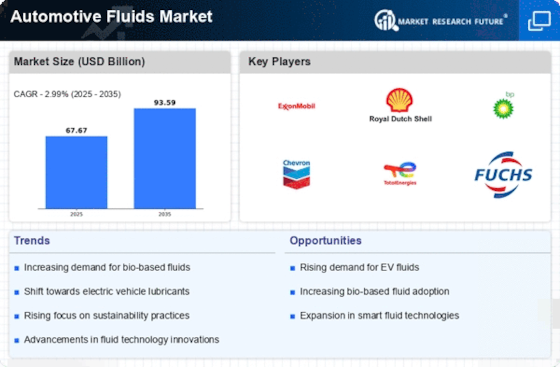

Technological advancements in fluid formulation are significantly influencing the automotive fluids market. Innovations in synthetic and bio-based fluids are enhancing performance characteristics, such as improved thermal stability and reduced friction. For instance, the introduction of high-performance synthetic oils is expected to capture a larger market share, as they offer extended service intervals and better fuel efficiency. The market for synthetic automotive fluids is anticipated to grow at a compound annual growth rate of around 5% through 2025. These advancements not only improve vehicle performance but also align with the increasing regulatory pressures for lower emissions, thereby driving the demand for advanced automotive fluids.

Regulatory Compliance and Environmental Standards

The automotive fluids market is increasingly shaped by stringent regulatory compliance and environmental standards. Governments worldwide are implementing regulations aimed at reducing emissions and promoting the use of eco-friendly fluids. This shift is compelling manufacturers to innovate and develop products that meet these standards, such as low-VOC and biodegradable fluids. The market for environmentally friendly automotive fluids is projected to grow significantly, as consumers and businesses alike seek to comply with these regulations. By 2025, it is anticipated that the demand for eco-friendly automotive fluids will constitute a substantial segment of the market, reflecting a broader trend towards sustainability in the automotive sector.