Top Industry Leaders in the Automotive Finance Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Automotive Finance industry are:

Ally Financial

Bank of America

Capital One

Chase Auto Finance

Daimler Financial Services

Ford Motor Credit Company

GM Financial Inc.

Hitachi Capital

Toyota Financial Services

Volkswagen Financial Services

Bridging the Gap by Exploring the Competitive Landscape of the Automotive Finance Top Players

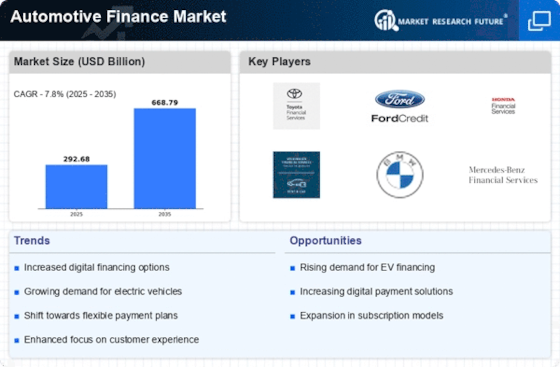

The automotive finance market presents a dynamic and ever-evolving landscape for players to maneuver. Understanding the key strategies adopted, emerging trends, and factors influencing market share is crucial for navigating this competitive arena.

Traditional Titans and FinTech Disruptors:

The market is dominated by established players like captive finance arms of major automakers (Toyota Financial Services, Ford Credit), large banks (Wells Fargo, Bank of America), and independent finance companies (Ally Financial). These players leverage their extensive branch networks, strong brand recognition, and established relationships with dealerships to maintain a significant market share.

However, the rise of FinTech startups is shaking the traditional landscape. These companies offer innovative digital platforms, streamlined loan processes, and competitive rates, attracting tech-savvy customers who value convenience and speed. Players like Klarna, Upstart, and Affirm are blurring the lines between traditional financing and point-of-sale lending, offering alternative solutions for consumers.

Key Strategies for Growth:

To stay ahead of the curve, players are employing various strategies:

• Personalization and Data Analytics: Leveraging customer data and AI-powered algorithms, companies are tailoring loan offers and interest rates to individual needs, enhancing customer satisfaction and loyalty.

• Digital Transformation: Embracing digital platforms and mobile apps is streamlining the loan application process, improving accessibility for customers and reducing operational costs for lenders.

• Partnerships and Collaborations: Strategic alliances with dealerships, online car buying platforms, and insurance providers are expanding reach and offering bundled services to attract a wider customer base.

• Alternative Lending Products: Offering flexible loan options like lease-to-own, balloon payments, and graduated payments caters to diverse customer needs and risk profiles, increasing market penetration.

Market Share Analysis:

Factors influencing market share are diverse and constantly evolving. Some key aspects to consider include:

• Geographic Presence: Strong regional presence, particularly in fast-growing markets like Asia and Latin America, provides a competitive edge.

• Product Portfolio Diversity: Offering a range of loan products for various vehicle segments (new, used, luxury) and credit profiles expands market reach.

• Interest Rate Competitiveness: Attractive rates and flexible terms lure borrowers, especially in a rising interest rate environment.

• Customer Service Excellence: Providing exceptional customer service builds trust and loyalty, leading to repeat business and referrals.

• Technological Innovation: Continuously investing in digital platforms, data analytics, and AI-powered solutions improves efficiency and customer experience.

New and Emerging Trends:

Several trends are shaping the future of automotive finance:

• Rise of Used Cars: The used car market is booming, and lenders are adapting by offering specialized financing options for pre-owned vehicles.

• Subscription Models: Car subscription services are gaining popularity, offering flexible access to vehicles without ownership commitments. This necessitates innovative financing solutions tailored to this evolving segment.

• Sustainability Focus: Green financing options for eco-friendly vehicles are becoming increasingly popular, aligning with growing environmental awareness.

• Blockchain Integration: Blockchain technology has the potential to streamline loan processes, enhance security, and improve transparency in the automotive finance industry.

Overall Competitive Scenario:

The automotive finance market is characterized by intense competition, with both traditional and FinTech players vying for market share. The key to success lies in adapting to changing customer preferences, embracing digital technologies, and offering personalized and competitive financial solutions. By staying agile and innovative, players can navigate this dynamic landscape and secure a winning position in the years to come.

Latest Company Updates:

Ally Financial: Launched a new digital platform for auto loan refinancing in June 2023. Partnered with Hyundai Motor America to offer EV financing solutions in October 2023. (Source: Ally Financial press releases)

Bank of America: Announced a $25 billion commitment to sustainable finance initiatives, including EV financing, in September 2023. Launched a pilot program for used EV financing in partnership with Rivian in December 2023. (Source: Bank of America press releases)

Capital One: Partnered with ChargePoint to offer EV charging station discounts to auto loan customers in May 2023. Expanded its auto refinance offerings in November 2023. (Source: Capital One press releases)

Chase Auto Finance: Introduced a new online pre-qualification tool for auto loans in July 2023. Partnered with Tesla to offer financing for Semi trucks in October 2023. (Source: Chase Auto Finance website)

Daimler Financial Services: Announced plans to invest €1 billion in EV charging infrastructure in Europe by 2025. Launched a subscription service for Mercedes-Benz EVs in the US in November 2023. (Source: Daimler Financial Services press releases)