Market Growth Projections

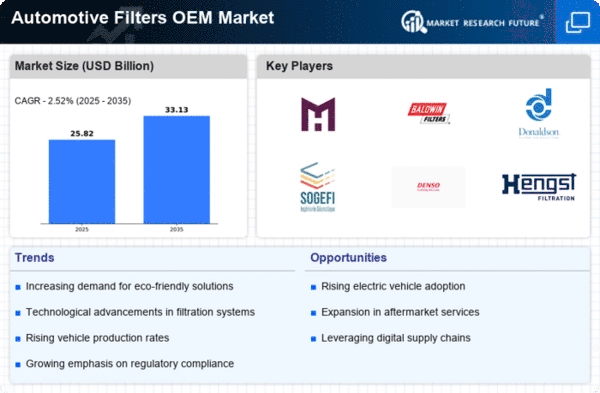

The Global Automotive Filters OEM Market Industry is projected to experience steady growth, with a compound annual growth rate (CAGR) of 2.52% anticipated from 2025 to 2035. This growth trajectory reflects the increasing demand for automotive filters driven by various factors, including rising vehicle production and stringent emission regulations. The market is expected to reach 33.1 USD Billion by 2035, indicating a robust expansion in the coming years. These projections suggest a favorable environment for manufacturers and suppliers, as they navigate the evolving landscape of the automotive industry and adapt to changing consumer preferences.

Growing Vehicle Production

The Global Automotive Filters OEM Market Industry is experiencing growth due to the increasing production of vehicles worldwide. In 2024, the market is projected to reach 25.2 USD Billion, driven by rising consumer demand for personal and commercial vehicles. As automotive manufacturers ramp up production to meet this demand, the need for high-quality filters becomes paramount. Filters play a crucial role in maintaining engine efficiency and prolonging vehicle lifespan, which is essential for manufacturers aiming to enhance customer satisfaction. This trend is expected to continue, with the market anticipated to grow steadily through 2035, reaching 33.1 USD Billion.

Stringent Emission Regulations

The Global Automotive Filters OEM Market Industry is significantly influenced by stringent emission regulations imposed by governments worldwide. These regulations aim to reduce harmful emissions from vehicles, thereby increasing the demand for advanced filtration systems. As manufacturers strive to comply with these regulations, they are investing in innovative filter technologies that enhance air and oil filtration efficiency. This trend not only supports environmental sustainability but also drives the market's growth. The ongoing evolution of regulations is likely to create new opportunities for filter manufacturers, as they develop products that meet or exceed compliance standards.

Expansion of Aftermarket Services

The expansion of aftermarket services is a notable driver of the Global Automotive Filters OEM Market Industry. As the automotive sector evolves, there is a growing emphasis on providing comprehensive maintenance and repair services. This trend is particularly relevant in the context of the increasing vehicle population, which creates a robust demand for replacement filters. Aftermarket services are becoming more sophisticated, with companies offering tailored solutions that cater to specific vehicle needs. This expansion not only enhances customer satisfaction but also drives sales of OEM filters, as consumers seek quality products that ensure optimal vehicle performance.

Rising Awareness of Vehicle Maintenance

The Global Automotive Filters OEM Market Industry benefits from the rising awareness of vehicle maintenance among consumers. As vehicle owners become more informed about the importance of regular maintenance, the demand for quality filters is likely to increase. Filters are essential components that contribute to the overall performance and longevity of vehicles. This growing awareness is prompting consumers to invest in OEM filters rather than cheaper alternatives, as they recognize the long-term benefits of using high-quality products. Consequently, this trend is expected to bolster the market, as manufacturers respond to the increasing demand for reliable filtration solutions.

Technological Advancements in Filtration

Technological advancements in filtration systems are a key driver of the Global Automotive Filters OEM Market Industry. Innovations such as high-efficiency particulate air filters and electrostatic filters are gaining traction, offering improved performance and durability. These advancements are crucial as consumers increasingly seek vehicles with enhanced fuel efficiency and lower emissions. The integration of smart technologies into filtration systems may also emerge, allowing for real-time monitoring and maintenance alerts. As these technologies evolve, they are expected to reshape the market landscape, providing manufacturers with opportunities to differentiate their products and meet the demands of modern consumers.