Regulatory Compliance

Regulatory compliance is a significant driver in the Automotive Fabrics Market. Governments worldwide are implementing stringent regulations regarding vehicle safety, emissions, and material sourcing. These regulations compel manufacturers to adopt safer and more sustainable materials in their automotive fabrics. Compliance not only ensures market access but also enhances brand reputation among environmentally conscious consumers. The market is witnessing a shift towards fabrics that meet these regulatory standards, with a growing emphasis on non-toxic and recyclable materials. This trend is likely to shape product development strategies in the automotive fabrics sector.

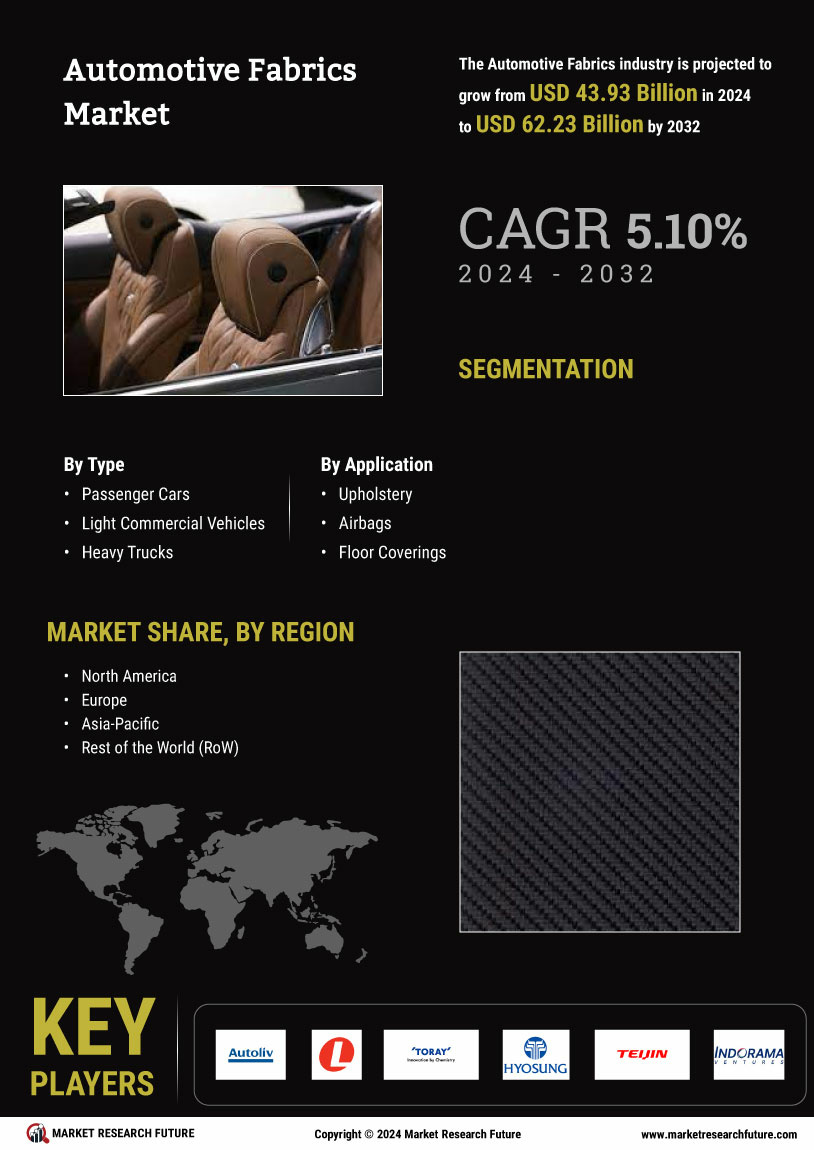

Rising Vehicle Production

Rising vehicle production is a fundamental driver of the Automotive Fabrics Market. As global demand for vehicles continues to increase, manufacturers are ramping up production to meet this need. This surge in vehicle production directly correlates with the demand for automotive fabrics, as each vehicle requires a variety of textile components for interiors, seats, and upholstery. Market forecasts indicate that vehicle production is expected to grow steadily, with estimates suggesting an increase of several million units annually over the next few years. Consequently, this growth is likely to bolster the automotive fabrics market, creating opportunities for manufacturers to expand their offerings.

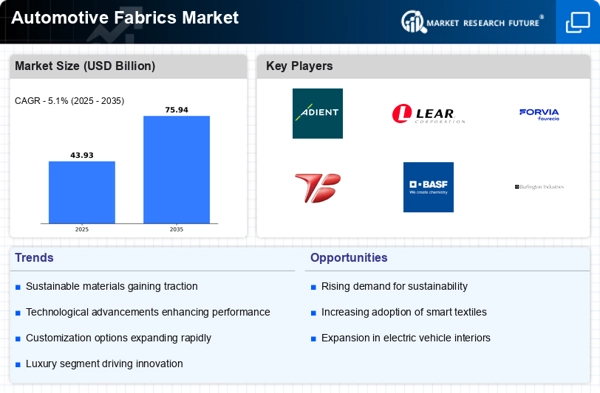

Technological Integration

Technological integration plays a pivotal role in the Automotive Fabrics Market. Advancements in textile technology, such as the development of smart fabrics, are transforming the landscape. These fabrics can incorporate features like temperature regulation, moisture-wicking, and even embedded sensors for enhanced functionality. The market is witnessing a surge in demand for such innovative materials, with projections indicating that smart textiles could account for a substantial share of the automotive fabrics market by 2027. This integration of technology not only enhances the user experience but also aligns with the automotive industry's push towards automation and connectivity.

Sustainability Initiatives

The Automotive Fabrics Market is increasingly influenced by sustainability initiatives. Manufacturers are focusing on eco-friendly materials, such as recycled polyester and organic cotton, to meet consumer demand for environmentally responsible products. This shift is not merely a trend; it reflects a broader commitment to reducing carbon footprints and promoting sustainable practices. In fact, the market for sustainable automotive fabrics is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. As automakers strive to enhance their green credentials, the demand for sustainable fabrics is likely to rise, driving innovation and investment in this sector.

Customization and Personalization

Customization and personalization are becoming increasingly vital in the Automotive Fabrics Market. Consumers are seeking unique and tailored experiences, prompting manufacturers to offer a wider range of fabric options, colors, and textures. This trend is particularly evident in the luxury vehicle segment, where bespoke interiors are a selling point. Market data suggests that the demand for personalized automotive interiors is expected to grow, with a notable increase in consumer willingness to pay for customized features. As a result, manufacturers are investing in flexible production processes to accommodate this shift, thereby enhancing their competitive edge.