Increase in Vehicle Electrification

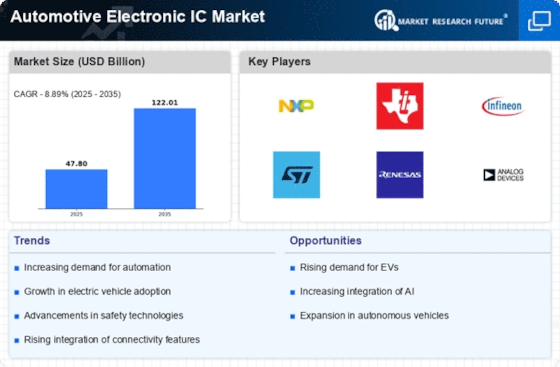

The automotive industry is witnessing a pronounced shift towards electrification, which is significantly impacting the Automotive Electronic IC Market. As manufacturers increasingly adopt electric vehicle (EV) technologies, the demand for electronic components, particularly integrated circuits, is surging. In 2025, it is estimated that the market for automotive electronic ICs will grow at a compound annual growth rate (CAGR) of approximately 10%. This growth is driven by the need for advanced battery management systems, power electronics, and energy-efficient solutions. Consequently, the Automotive Electronic IC Market is poised to expand as automakers invest heavily in research and development to enhance vehicle performance and sustainability.

Growing Demand for In-Vehicle Connectivity

The rising consumer expectation for connectivity features in vehicles is a pivotal driver for the Automotive Electronic IC Market. With the advent of smart technologies, consumers are increasingly seeking seamless integration of their devices with their vehicles. This trend is reflected in the projected growth of the connected car market, which is expected to exceed 50 billion USD by 2025. Automotive electronic ICs play a crucial role in enabling features such as infotainment systems, vehicle-to-everything (V2X) communication, and over-the-air updates. Consequently, the Automotive Electronic IC Market is likely to expand as manufacturers strive to meet the growing demand for enhanced connectivity and user experience.

Regulatory Push for Safety and Emissions Standards

Regulatory frameworks aimed at enhancing vehicle safety and reducing emissions are significantly influencing the Automotive Electronic IC Market. Governments worldwide are implementing stringent regulations that necessitate the incorporation of advanced electronic systems in vehicles. For instance, the European Union has set ambitious targets for reducing carbon emissions, which compels manufacturers to adopt more efficient electronic solutions. This regulatory environment is expected to drive the demand for automotive electronic ICs, as they are integral to the development of systems that comply with these standards. The Automotive Electronic IC Market is thus likely to benefit from the increasing focus on safety and environmental sustainability.

Emergence of Advanced Driver Assistance Systems (ADAS)

The proliferation of Advanced Driver Assistance Systems (ADAS) is reshaping the Automotive Electronic IC Market. These systems, which include features such as adaptive cruise control, lane-keeping assistance, and automatic emergency braking, rely heavily on sophisticated electronic components. The market for ADAS is projected to reach a valuation of over 30 billion USD by 2025, indicating a robust demand for automotive electronic ICs. This trend suggests that manufacturers must prioritize the integration of high-performance ICs to ensure the reliability and safety of these systems. As a result, the Automotive Electronic IC Market is likely to experience substantial growth driven by the increasing adoption of ADAS technologies.

Technological Advancements in Semiconductor Manufacturing

Technological advancements in semiconductor manufacturing are poised to revolutionize the Automotive Electronic IC Market. Innovations such as the development of smaller, more efficient chips are enabling the production of high-performance electronic components that meet the demands of modern vehicles. The introduction of 5nm and 7nm process technologies is expected to enhance the capabilities of automotive electronic ICs, allowing for greater functionality and reduced power consumption. As the automotive sector increasingly relies on sophisticated electronics, the Automotive Electronic IC Market is likely to experience growth driven by these advancements, which facilitate the integration of cutting-edge technologies into vehicles.