Growing Importance of Customer Reviews and Ratings

In the Automotive ECommerce Market, customer reviews and ratings are becoming increasingly influential in shaping purchasing decisions. Research shows that approximately 80 percent of consumers consider online reviews as a critical factor when selecting a vehicle. This trend underscores the importance of transparency and trust in the online automotive marketplace. As consumers rely heavily on the experiences of others, businesses are compelled to prioritize customer satisfaction and actively manage their online reputations. The proliferation of social media and review platforms has amplified the impact of customer feedback, making it essential for automotive eCommerce companies to engage with their audience. Consequently, the Automotive ECommerce Market is likely to see a shift towards more customer-centric practices, as companies strive to build trust and credibility in an increasingly competitive landscape.

Technological Advancements in Automotive ECommerce

The Automotive ECommerce Market is experiencing a surge in technological advancements that enhance the online shopping experience. Innovations such as augmented reality (AR) and virtual reality (VR) allow consumers to visualize vehicles in a more immersive manner. Additionally, the integration of artificial intelligence (AI) in customer service and personalized recommendations is becoming increasingly prevalent. According to recent data, approximately 70 percent of consumers express a preference for online vehicle purchases facilitated by advanced technologies. This trend indicates a shift in consumer behavior, as buyers seek convenience and efficiency in their purchasing journey. Furthermore, the rise of mobile applications tailored for automotive sales is likely to drive market growth, as they provide users with easy access to information and purchasing options. Overall, these technological advancements are reshaping the Automotive ECommerce Market, making it more accessible and user-friendly.

Expansion of Financing Options in Automotive ECommerce

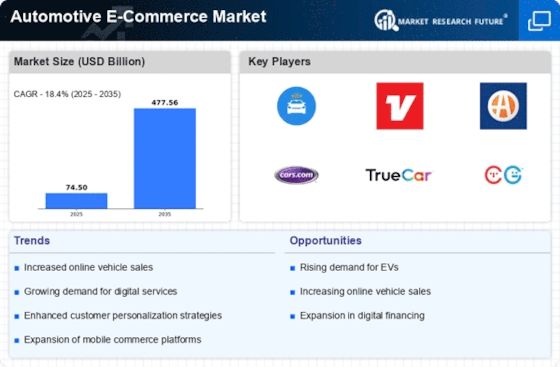

The Automotive ECommerce Market is experiencing a transformation in financing options available to consumers. Traditionally, financing for vehicle purchases was primarily conducted through dealerships. However, the rise of online platforms has introduced a variety of financing solutions, including peer-to-peer lending and online credit assessments. Recent data indicates that nearly 40 percent of consumers prefer to secure financing online before making a purchase. This trend not only streamlines the buying process but also empowers consumers to make informed financial decisions. As more financial institutions partner with automotive eCommerce platforms, the accessibility of financing options is likely to improve, further driving market growth. The expansion of these financing alternatives is indicative of a broader shift in the Automotive ECommerce Market, where convenience and flexibility are paramount for modern consumers.

Increased Consumer Demand for Online Vehicle Purchases

The Automotive ECommerce Market is witnessing a notable increase in consumer demand for online vehicle purchases. Recent surveys indicate that over 60 percent of potential car buyers are inclined to explore online platforms for their next vehicle acquisition. This shift in consumer preference is driven by the convenience of browsing extensive inventories from the comfort of home, coupled with the ability to compare prices and features effortlessly. Additionally, the availability of detailed product information and customer reviews online enhances buyer confidence. As a result, automotive manufacturers and dealerships are increasingly investing in their online presence to cater to this growing demand. The trend suggests that the Automotive ECommerce Market is likely to expand further, as more consumers embrace the digital landscape for their automotive needs. This evolution may lead to a more competitive market, with businesses striving to enhance their online offerings.

Integration of Sustainable Practices in Automotive ECommerce

The Automotive ECommerce Market is increasingly integrating sustainable practices into its operations, reflecting a growing consumer preference for eco-friendly options. Recent studies indicate that nearly 50 percent of consumers are willing to pay a premium for vehicles that are environmentally friendly. This trend is prompting automotive companies to enhance their online offerings with electric and hybrid vehicles, as well as promote sustainable manufacturing processes. Additionally, the rise of online platforms that specialize in eco-friendly vehicles is likely to attract environmentally conscious consumers. As sustainability becomes a key consideration in purchasing decisions, the Automotive ECommerce Market is expected to adapt by prioritizing green initiatives and transparent practices. This shift not only aligns with consumer values but also positions companies favorably in a market that increasingly values corporate responsibility.