Expansion of Electric Vehicle Market

The Automotive Disc Coupling Market is poised for growth due to the rapid expansion of the electric vehicle (EV) market. As the automotive landscape shifts towards electrification, the demand for specialized components that can handle the unique requirements of electric drivetrains is increasing. Disc couplings are essential in electric vehicles for ensuring efficient torque transfer and accommodating the high torque characteristics of electric motors. Recent projections indicate that the EV market is expected to grow at a staggering rate, with sales anticipated to reach over 30 million units by 2030. This surge in electric vehicle production is likely to create substantial opportunities for the Automotive Disc Coupling Market, as manufacturers adapt their offerings to meet the evolving needs of the automotive sector.

Increased Focus on Vehicle Performance

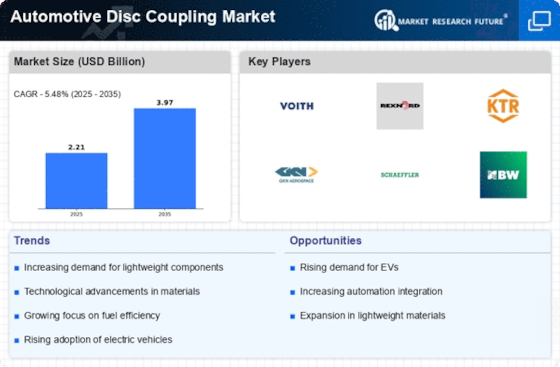

The Automotive Disc Coupling Market is significantly influenced by the heightened focus on vehicle performance. As consumers demand higher levels of performance, manufacturers are compelled to innovate and enhance their product offerings. Disc couplings are integral to the drivetrain, ensuring optimal power transmission and minimizing energy losses. Recent market analyses indicate that the performance-oriented segment of the automotive industry is projected to grow at a compound annual growth rate of approximately 5% over the next five years. This trend suggests that the Automotive Disc Coupling Market will benefit from the increasing integration of high-performance components, as automakers seek to deliver superior driving experiences.

Rising Demand for Lightweight Materials

The Automotive Disc Coupling Market is experiencing a notable increase in demand for lightweight materials. This trend is driven by the automotive sector's ongoing efforts to enhance fuel efficiency and reduce emissions. Manufacturers are increasingly adopting advanced materials such as composites and aluminum alloys, which contribute to weight reduction without compromising performance. According to recent data, the use of lightweight components can lead to a reduction in vehicle weight by up to 20%, thereby improving fuel economy. As automakers strive to meet stringent regulatory standards, the shift towards lightweight materials is likely to bolster the growth of the Automotive Disc Coupling Market, as these components play a crucial role in the overall vehicle dynamics and efficiency.

Regulatory Compliance and Emission Standards

The Automotive Disc Coupling Market is significantly impacted by stringent regulatory compliance and emission standards. Governments worldwide are implementing increasingly rigorous regulations aimed at reducing vehicular emissions and promoting sustainability. As a result, automotive manufacturers are compelled to adopt advanced technologies and components that align with these regulations. Disc couplings, which enhance drivetrain efficiency, play a vital role in helping manufacturers meet these standards. Data suggests that vehicles equipped with high-efficiency couplings can achieve up to a 15% reduction in emissions. Consequently, the Automotive Disc Coupling Market is likely to see growth as manufacturers prioritize compliance and invest in innovative coupling solutions to meet regulatory demands.

Technological Innovations in Coupling Design

The Automotive Disc Coupling Market is benefiting from ongoing technological innovations in coupling design. Advances in engineering and materials science are leading to the development of more efficient and durable disc couplings. Innovations such as improved vibration dampening and enhanced torque capacity are becoming increasingly prevalent. These advancements not only improve the performance of the couplings but also extend their lifespan, reducing maintenance costs for manufacturers and consumers alike. Market data indicates that the adoption of innovative coupling designs could enhance overall vehicle reliability by up to 10%. As the automotive industry continues to evolve, the Automotive Disc Coupling Market is likely to thrive, driven by the demand for cutting-edge coupling solutions.