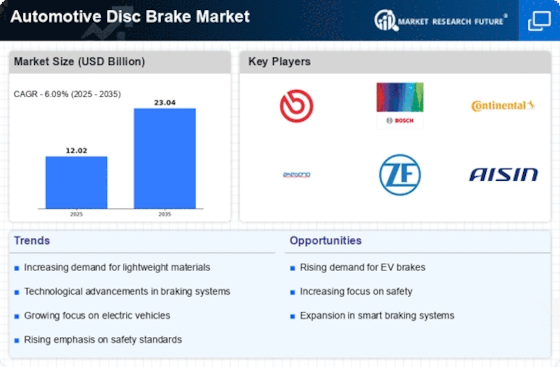

Increasing Vehicle Production

The automotive industry is witnessing a surge in vehicle production, which directly influences the Automotive Disc Brake Market. As manufacturers ramp up production to meet consumer demand, the need for efficient braking systems becomes paramount. In 2025, the production of passenger vehicles is projected to reach approximately 80 million units, indicating a robust growth trajectory. This increase in vehicle output necessitates a corresponding rise in the demand for disc brakes, as they are integral to vehicle safety and performance. Consequently, manufacturers are likely to invest in advanced disc brake technologies to enhance braking efficiency and reduce wear, thereby propelling the Automotive Disc Brake Market forward.

Rising Demand for Performance Vehicles

The growing consumer preference for performance-oriented vehicles is a notable driver of the Automotive Disc Brake Market. As enthusiasts seek vehicles that offer superior handling and braking capabilities, manufacturers are compelled to develop high-performance disc brake systems. This trend is particularly evident in the sports car segment, where advanced braking technologies are essential for optimal performance. The performance vehicle market is projected to expand, with an increasing number of consumers willing to invest in vehicles that provide enhanced driving experiences. This shift is likely to stimulate innovation within the Automotive Disc Brake Market, as manufacturers strive to meet the demands of performance-focused consumers.

Expansion of Electric and Hybrid Vehicles

The rise of electric and hybrid vehicles is reshaping the Automotive Disc Brake Market. As these vehicles gain popularity, there is a growing need for specialized braking systems that cater to their unique requirements. Electric vehicles, in particular, often utilize regenerative braking systems, which require disc brakes that can withstand different operational conditions. The market for electric and hybrid vehicles is expected to grow significantly, with projections indicating that they could account for a substantial share of total vehicle sales by 2030. This transition presents opportunities for manufacturers to innovate and adapt their disc brake offerings, ensuring they meet the evolving needs of the Automotive Disc Brake Market.

Regulatory Compliance and Safety Standards

Stringent safety regulations and compliance standards are driving the Automotive Disc Brake Market. Governments worldwide are implementing rigorous safety measures to ensure that vehicles meet specific performance criteria. For instance, regulations regarding stopping distances and brake performance are becoming increasingly stringent. This regulatory landscape compels manufacturers to innovate and enhance their disc brake systems to comply with these standards. As a result, the market is likely to see advancements in materials and designs that improve braking efficiency and safety. The emphasis on safety not only influences consumer preferences but also shapes the competitive dynamics within the Automotive Disc Brake Market.

Technological Advancements in Brake Systems

The Automotive Disc Brake Market is significantly influenced by technological advancements in braking systems. Innovations such as anti-lock braking systems (ABS), electronic brake-force distribution (EBD), and regenerative braking technologies are becoming more prevalent. These technologies enhance vehicle safety and performance, leading to increased consumer acceptance and demand. In 2025, the market for advanced braking systems is expected to grow substantially, driven by the integration of smart technologies and automation in vehicles. This trend indicates a shift towards more sophisticated braking solutions, which could reshape the competitive landscape of the Automotive Disc Brake Market.