Market Analysis

In-depth Analysis of Automotive Diagnostic Tool Market Industry Landscape

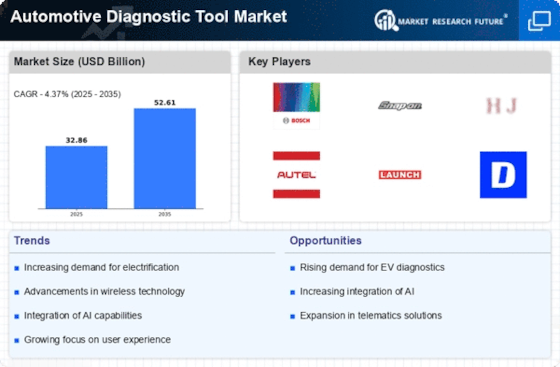

The automotive diagnostic tool industry relies heavily on technological progress, and in the past year, the automotive sector has witnessed significant advancements. These include the rise of autonomous vehicles, increased connectivity, electrification, shared mobility, artificial intelligence, and various other innovations. From the inception of engines powered by fossil fuels, technology has played a pivotal role in shaping the automotive landscape. Automotive diagnostic tools, crucial for identifying and troubleshooting defects in a vehicle's engine, gearbox, fuel system, battery, and electronic systems, have evolved to keep pace with these technological changes. On-board Diagnostics (OBD) technology, capable of detecting and analyzing faulty components and locations, has become a cornerstone in automotive diagnostics.

Major players in the industry are actively engaged in activities such as product launches, strategic agreements, and acquisitions to fortify their positions in the market. A notable example is Continental AG (Germany), which, in July 2020, introduced the Autodiagnos Pro Automotive Diagnostic System. Tailored to assist automobile technicians in swiftly analyzing, diagnosing, and repairing vehicles, this innovative scan tool is compatible with all brands and models. Its regular updates ensure compatibility with the evolving nature of vehicles.

The landscape of automotive diagnostics is expanding further with the introduction of cutting-edge technologies. Inter-car communication, augmented reality (AR) dashboard displays, seamless integration with mobile phones and smartwatches, automated parking systems, and 3D gesture technology are among the latest solutions aimed at enhancing driving safety and providing a more engaging driving experience. These advancements contribute to the overall growth of the automotive diagnostic tool market, as they cater to the evolving needs and preferences of vehicle owners and drivers.

The automotive industry's global embrace of technological enhancements is a driving force behind the growing demand for automotive diagnostic tools. The integration of these tools into the maintenance and repair processes is becoming increasingly vital as vehicles become more complex and technologically sophisticated. Automotive technicians rely on advanced diagnostic tools to efficiently identify and rectify issues within vehicles, ensuring optimal performance and safety.

The automotive diagnostic tool market is intricately linked to the continuous technological evolution in the automotive industry. The surge in autonomous vehicles, increased connectivity, electrification, and other advancements has propelled the need for sophisticated diagnostic tools. The Autodiagnos Pro Automotive Diagnostic System and similar innovations underscore the commitment of key players to stay ahead in this dynamic market. As technologies continue to redefine the automotive landscape, the demand for advanced diagnostic tools is poised to grow, ensuring the continued efficiency and safety of vehicles worldwide.

Leave a Comment