Regulatory Compliance

The Global Automotive Dealer Management System Market Industry is also driven by the need for regulatory compliance. As governments worldwide implement stricter regulations regarding data protection, emissions, and consumer rights, dealers must ensure their operations align with these requirements. DMS solutions provide the necessary tools to manage compliance efficiently, reducing the risk of penalties and enhancing operational transparency. This growing emphasis on compliance is likely to propel the adoption of DMS among automotive dealers, contributing to the market's projected growth from 6.09 USD Billion in 2024 to 11.2 USD Billion by 2035.

Market Growth Projections

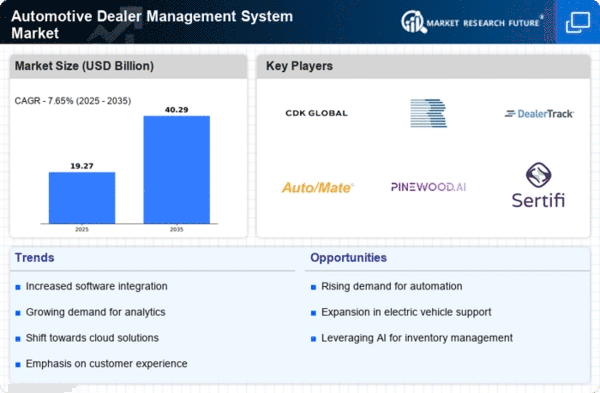

The Global Automotive Dealer Management System Market Industry is characterized by robust growth projections. The market is expected to reach a valuation of 6.09 USD Billion in 2024, with an anticipated increase to 11.2 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 5.67% from 2025 to 2035. Such figures underscore the increasing reliance on DMS among automotive dealers as they seek to enhance operational efficiency and customer satisfaction. The market's expansion is indicative of broader trends within the automotive sector, where technology adoption is becoming increasingly critical.

Technological Advancements

The Global Automotive Dealer Management System Market Industry is experiencing rapid technological advancements, particularly in cloud computing and artificial intelligence. These innovations enhance operational efficiency and customer engagement, allowing dealers to streamline processes such as inventory management and sales tracking. For instance, the integration of AI-driven analytics enables dealers to predict customer preferences and optimize stock levels. This trend is likely to contribute to the market's growth, with projections indicating a market value of 6.09 USD Billion in 2024, potentially reaching 11.2 USD Billion by 2035, reflecting a compound annual growth rate of 5.67% from 2025 to 2035.

Rising Consumer Expectations

The Global Automotive Dealer Management System Market Industry is significantly influenced by rising consumer expectations for personalized services and seamless experiences. Customers today demand tailored interactions and quick responses, prompting dealers to adopt advanced DMS solutions that can provide real-time data and insights. This shift towards customer-centric strategies is crucial for maintaining competitiveness in the automotive sector. As dealers invest in technology to meet these expectations, the market is projected to grow from 6.09 USD Billion in 2024 to 11.2 USD Billion by 2035, indicating a robust CAGR of 5.67% from 2025 to 2035.

Increasing Demand for Automation

The Global Automotive Dealer Management System Market Industry is witnessing a surge in demand for automation solutions. Dealers are increasingly adopting DMS to automate routine tasks, thereby reducing human error and improving efficiency. Automation facilitates seamless communication between departments, enhances customer service, and accelerates the sales process. As a result, dealers can focus on strategic initiatives rather than mundane tasks. This shift towards automation is expected to drive the market's growth, as businesses recognize the potential for increased profitability and customer satisfaction. The anticipated growth trajectory suggests a market size of 6.09 USD Billion in 2024, with a potential rise to 11.2 USD Billion by 2035.

Expansion of Electric Vehicle Market

The Global Automotive Dealer Management System Market Industry is poised for growth due to the expansion of the electric vehicle market. As more consumers shift towards electric vehicles, dealers require sophisticated DMS to manage the unique aspects of electric vehicle sales, including inventory management, service scheduling, and customer education. This transition necessitates advanced technology solutions that can accommodate the complexities of electric vehicle transactions. The increasing focus on sustainability and the anticipated growth in electric vehicle sales are expected to drive the DMS market, with projections indicating a rise from 6.09 USD Billion in 2024 to 11.2 USD Billion by 2035.