Expansion of Aftermarket Services

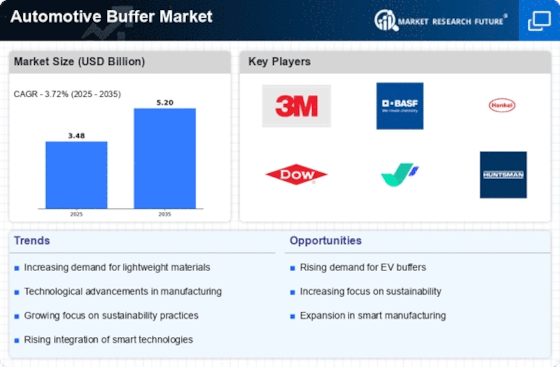

The Automotive Buffer Market is experiencing growth due to the expansion of aftermarket services. As vehicle ownership rates rise, the demand for replacement parts, including automotive buffers, is increasing. Consumers are becoming more aware of the importance of maintaining vehicle performance and comfort, leading to a surge in demand for high-quality aftermarket buffers. This trend is further supported by the rise of e-commerce platforms that facilitate easy access to automotive parts. According to recent market analysis, the aftermarket automotive parts industry is projected to grow at a steady rate, indicating a robust opportunity for the Automotive Buffer Market. This expansion suggests that manufacturers will need to focus on quality and availability to meet the evolving needs of consumers.

Growth in Electric Vehicle Production

The Automotive Buffer Market is poised for growth due to the rapid expansion of electric vehicle (EV) production. As manufacturers pivot towards electrification, the demand for specialized automotive buffers that cater to the unique requirements of EVs is increasing. These buffers play a crucial role in managing vibrations and ensuring passenger comfort, which is particularly important in electric vehicles that often feature different weight distributions and noise characteristics compared to traditional combustion engines. Recent statistics indicate that the EV market is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend suggests that the Automotive Buffer Market will need to adapt and innovate to meet the evolving needs of electric vehicle manufacturers.

Rising Demand for Lightweight Materials

The Automotive Buffer Market experiences a notable increase in demand for lightweight materials, driven by the automotive sector's focus on enhancing fuel efficiency and reducing emissions. Manufacturers are increasingly adopting advanced materials such as composites and polymers, which contribute to weight reduction without compromising performance. This shift is evident as automakers aim to meet stringent regulatory standards regarding emissions. According to recent data, the use of lightweight materials in vehicles can lead to a reduction in weight by up to 30%, thereby improving fuel economy. As a result, the Automotive Buffer Market is likely to witness a surge in the adoption of lightweight buffers that align with these sustainability goals, ultimately enhancing vehicle performance and consumer appeal.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are significantly influencing the Automotive Buffer Market. Innovations such as 3D printing and automation are enabling manufacturers to produce high-quality buffers with enhanced precision and efficiency. These technologies not only reduce production costs but also allow for greater customization of automotive buffers to meet specific vehicle requirements. Furthermore, the integration of smart materials that respond to environmental changes is becoming more prevalent, offering potential improvements in performance and durability. As the automotive industry continues to embrace these technological innovations, the Automotive Buffer Market is likely to benefit from increased production capabilities and the introduction of next-generation products that enhance vehicle performance.

Increasing Focus on Vehicle Safety Standards

The Automotive Buffer Market is significantly impacted by the increasing focus on vehicle safety standards. Regulatory bodies are continuously updating safety regulations, which necessitates the incorporation of advanced safety features in vehicles. Automotive buffers play a vital role in crash safety by absorbing impact energy and minimizing injury risks to passengers. As a result, manufacturers are compelled to invest in high-performance buffers that meet or exceed these safety standards. Recent data indicates that The Automotive Buffer Market is expected to grow substantially, further driving the demand for innovative buffer solutions. This trend suggests that the Automotive Buffer Market will continue to evolve, prioritizing safety alongside performance and comfort.