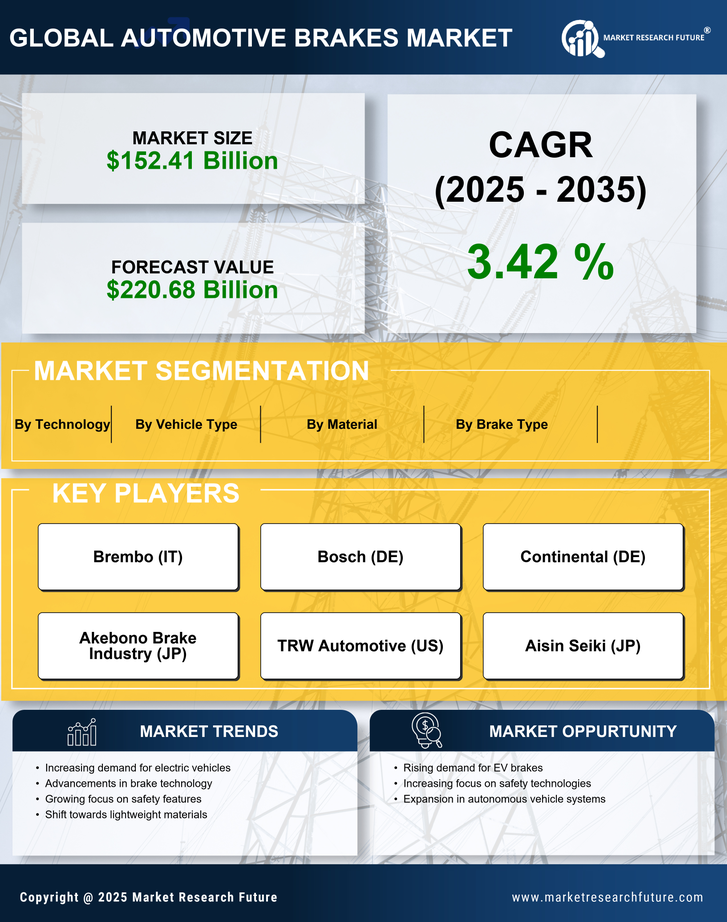

Increasing Vehicle Production

The automotive industry is witnessing a surge in vehicle production, which directly influences the Automotive Brakes Market. As manufacturers ramp up production to meet consumer demand, the need for reliable and efficient braking systems becomes paramount. In 2025, the production of passenger vehicles is projected to reach approximately 80 million units, indicating a robust growth trajectory. This increase in vehicle output necessitates a corresponding rise in brake system installations, thereby driving the market forward. Furthermore, the expansion of automotive manufacturing facilities in emerging economies contributes to this trend, as local production capabilities enhance supply chain efficiencies. Consequently, the Automotive Brakes Market is poised to benefit from this upward trend in vehicle production, as manufacturers seek to equip their vehicles with advanced braking technologies.

Regulatory Compliance and Safety Standards

Stringent safety regulations and compliance standards are pivotal in shaping the Automotive Brakes Market. Governments across various regions are implementing rigorous safety protocols to ensure that vehicles meet specific performance criteria. For instance, the introduction of new braking performance standards mandates that manufacturers enhance their braking systems to comply with these regulations. This regulatory landscape not only compels manufacturers to innovate but also drives the demand for advanced braking technologies. In 2025, it is anticipated that the market for advanced braking systems will grow significantly, as companies invest in research and development to meet these evolving standards. The Automotive Brakes Market, therefore, stands to gain from the increasing emphasis on safety and compliance, as manufacturers strive to align their products with regulatory expectations.

Technological Innovations in Brake Systems

Technological advancements in brake systems are a driving force behind the growth of the Automotive Brakes Market. Innovations such as electronic braking systems, anti-lock braking systems (ABS), and brake-by-wire technology are revolutionizing the way vehicles operate. These technologies not only improve braking performance but also enhance vehicle safety and control. In 2025, the market for electronic braking systems is expected to witness substantial growth, driven by the increasing adoption of these advanced technologies in new vehicle models. As manufacturers strive to differentiate their products in a competitive landscape, the emphasis on technological innovation becomes increasingly pronounced. The Automotive Brakes Market is thus positioned to benefit from these advancements, as consumers seek vehicles equipped with the latest braking technologies that offer superior performance and safety.

Growth of Electric and Hybrid Vehicle Segment

The increasing popularity of electric and hybrid vehicles is reshaping the Automotive Brakes Market. As these vehicles gain traction, there is a corresponding demand for specialized braking systems that cater to their unique requirements. Electric and hybrid vehicles often utilize regenerative braking systems, which differ from traditional braking technologies. In 2025, the market for electric vehicles is projected to reach approximately 30 million units, indicating a significant shift in consumer preferences. This transition necessitates the development of innovative braking solutions that enhance energy efficiency and performance. As a result, the Automotive Brakes Market is likely to evolve, with manufacturers focusing on creating braking systems that align with the characteristics of electric and hybrid vehicles, thereby capitalizing on this burgeoning segment.

Rising Demand for Advanced Driver Assistance Systems (ADAS)

The growing integration of Advanced Driver Assistance Systems (ADAS) in vehicles is a key driver for the Automotive Brakes Market. As consumers increasingly prioritize safety features, the demand for vehicles equipped with ADAS is on the rise. These systems often incorporate advanced braking technologies, such as automatic emergency braking and adaptive cruise control, which enhance overall vehicle safety. In 2025, the market for ADAS is expected to expand significantly, with projections indicating a compound annual growth rate of over 15%. This trend not only reflects consumer preferences but also highlights the automotive industry's commitment to innovation. Consequently, the Automotive Brakes Market is likely to experience substantial growth as manufacturers develop braking systems that are compatible with these advanced technologies.