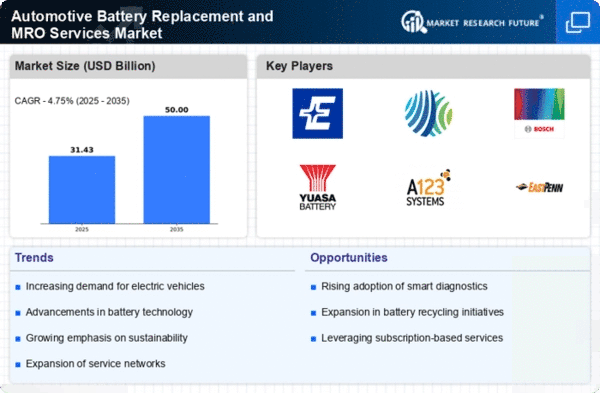

The Automotive Battery Replacement and MRO Services Market is currently characterized by a dynamic competitive landscape, driven by technological advancements, increasing consumer demand for electric vehicles (EVs), and a growing emphasis on sustainability. Key players such as Exide Technologies (US), Johnson Controls (US), and Bosch (DE) are strategically positioning themselves through innovation and partnerships. For instance, Exide Technologies (US) has focused on enhancing its product portfolio with advanced battery technologies, while Johnson Controls (US) has been investing in smart battery management systems to cater to the evolving needs of the automotive sector. Bosch (DE), on the other hand, is leveraging its expertise in automotive components to integrate battery solutions with broader vehicle systems, thereby shaping a competitive environment that prioritizes technological integration and customer-centric solutions.In terms of business tactics, companies are increasingly localizing manufacturing to reduce supply chain vulnerabilities and optimize logistics. The market structure appears moderately fragmented, with several players vying for market share, yet the collective influence of major companies like Yuasa Battery (JP) and A123 Systems (US) is notable. These firms are not only enhancing their operational efficiencies but are also collaborating with automotive manufacturers to ensure that their products meet the latest industry standards and consumer expectations.

In November Yuasa Battery (JP) announced a strategic partnership with a leading EV manufacturer to develop high-performance lithium-ion batteries tailored for electric vehicles. This collaboration is significant as it positions Yuasa to capitalize on the burgeoning EV market, potentially increasing its market share and reinforcing its reputation as a leader in battery technology. The partnership underscores the importance of aligning product offerings with market trends, particularly in the context of sustainability and energy efficiency.

In October A123 Systems (US) unveiled a new line of advanced battery solutions designed for commercial vehicles, emphasizing enhanced energy density and faster charging capabilities. This launch is crucial as it addresses the growing demand for efficient battery systems in the commercial sector, which is increasingly adopting electrification. A123's focus on innovation in battery technology may provide a competitive edge, allowing it to meet the specific needs of commercial fleet operators.

In September Bosch (DE) expanded its battery recycling program, aiming to recover valuable materials from used batteries. This initiative not only aligns with The Automotive Battery Replacement and MRO Services. The move reflects a broader trend towards circular economy practices within the automotive sector, where companies are increasingly held accountable for their environmental impact.

As of December the competitive trends in the Automotive Battery Replacement and MRO Services Market are heavily influenced by digitalization, sustainability, and the integration of artificial intelligence (AI) in battery management systems. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance their technological capabilities and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology integration, and supply chain reliability. This shift may redefine how companies approach market entry and product development, emphasizing the importance of adaptability in a rapidly changing landscape.