Consumer Preferences

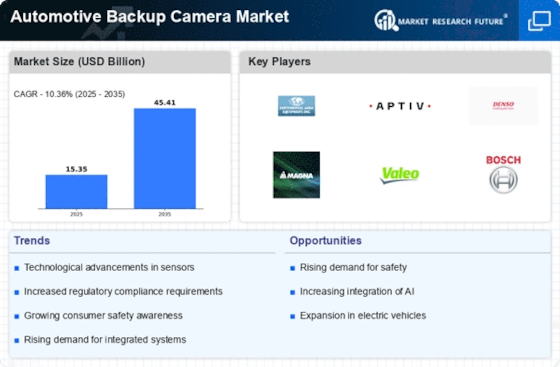

Consumer preferences are evolving, significantly impacting the Automotive Backup Camera Market. As awareness of vehicle safety increases, consumers are increasingly prioritizing advanced safety features, including backup cameras, when purchasing vehicles. Surveys indicate that a substantial percentage of potential car buyers consider backup cameras a necessary feature, influencing their purchasing decisions. This shift in consumer behavior is prompting automakers to integrate backup cameras as standard equipment in their vehicles. Market data suggests that the demand for vehicles equipped with backup cameras is expected to rise, with projections indicating a compound annual growth rate of over 10% in the coming years. This trend highlights the growing importance of consumer preferences in driving the Automotive Backup Camera Market.

Regulatory Influence

Regulatory influence plays a crucial role in shaping the Automotive Backup Camera Market. Governments across various regions have implemented stringent safety regulations mandating the inclusion of backup cameras in new vehicles. For instance, regulations in certain markets require all passenger vehicles to be equipped with rear visibility technology, which has led to a surge in demand for backup cameras. This regulatory push is expected to drive market growth, as manufacturers are compelled to comply with these standards. Data indicates that compliance with such regulations could potentially increase the market size by several billion dollars over the next few years, underscoring the importance of regulatory frameworks in the Automotive Backup Camera Market.

Technological Advancements

The Automotive Backup Camera Market is experiencing rapid technological advancements that enhance vehicle safety and convenience. Innovations such as high-definition cameras, night vision capabilities, and advanced image processing algorithms are becoming standard features in modern vehicles. These technologies not only improve the clarity of the images captured but also integrate with other safety systems, such as parking sensors and collision avoidance systems. According to recent data, the adoption of these advanced systems is projected to increase significantly, with estimates suggesting that by 2026, nearly 80% of new vehicles will be equipped with backup cameras. This trend indicates a strong growth trajectory for the Automotive Backup Camera Market, driven by consumer demand for enhanced safety features.

Increased Vehicle Production

The Automotive Backup Camera Market is also benefiting from increased vehicle production rates. As manufacturers ramp up production to meet rising consumer demand, the integration of backup cameras has become a standard practice. The automotive industry has seen a resurgence in production levels, with many manufacturers investing in new technologies and production facilities. This increase in vehicle output is likely to correlate with a higher installation rate of backup cameras, as automakers seek to enhance the safety features of their vehicles. Market analysis indicates that the production of vehicles equipped with backup cameras could reach over 50 million units annually by 2027, further propelling the growth of the Automotive Backup Camera Market.

Rising Awareness of Road Safety

Rising awareness of road safety is a pivotal driver for the Automotive Backup Camera Market. As accidents related to reversing vehicles continue to be a concern, there is a growing emphasis on technologies that can mitigate such risks. Educational campaigns and advocacy for safer driving practices have heightened public consciousness regarding the importance of backup cameras. This increased awareness is likely to lead to higher demand for vehicles equipped with these safety features. Market trends suggest that as more consumers recognize the benefits of backup cameras in preventing accidents, the Automotive Backup Camera Market could see a substantial increase in sales, potentially doubling in size over the next decade.