Top Industry Leaders in the Automotive Acoustic Engineering Services Market

*Disclaimer: List of key companies in no particular order

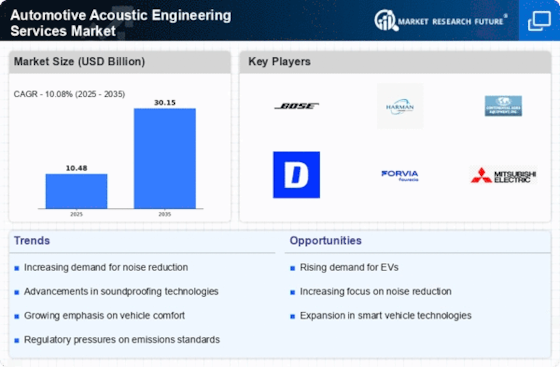

The automotive acoustic engineering services market, orchestrating the symphony of silence within vehicles, is revving up for a dynamic shift in its competitive landscape. Fueled by rising consumer expectations, stringent noise regulations, and the booming electric vehicle (EV) segment, established players are facing off against nimble innovators, creating a vibrant and increasingly diverse playing field.

Key Player Strategies:

Global Titans: Acoustic engineering stalwarts like AVL List, Siemens, and Harman International leverage their expansive global reach, comprehensive service offerings, and established relationships with major automakers to maintain their positions. They focus on continuous innovation, partnering with technology providers and research institutions to stay ahead of the curve. For example, AVL List acquired Soundeon, gaining expertise in sound design and virtual prototyping.

Regional Specialists: Regional players like Horiba MIRA and DEKRA Automotive excel in specific geographic markets, boasting strong ties with local automakers and understanding of regional regulations. They cater to regional preferences and offer cost-effective solutions tailored to specific needs. For instance, DEKRA Automotive established a dedicated NVH (noise, vibration, and harshness) testing facility in China, catering to the booming EV market.

Tech-Savvy Disruptors: Startups and smaller players are disrupting the market with cutting-edge solutions for EV-specific noise challenges, advanced simulation software, and data-driven noise optimization tools. Companies like Soundbox and n-com noise control specialize in electric motor and powertrain noise mitigation, addressing a critical pain point for EV manufacturers.

Factors for Market Share Analysis:

Service Portfolio Breadth: Offering a comprehensive range of services encompassing noise testing, simulation, material optimization, and noise reduction solutions provides a competitive advantage. Partnerships with technology providers further enhance portfolio value.

EV Expertise: With the EV segment booming, expertise in addressing EV-specific noise challenges like electric motor whine and wind noise is becoming increasingly valuable. Companies with proven solutions in this area will gain an edge.

Data Analytics and AI: Leveraging data analytics and AI for predictive noise management, virtual prototyping, and noise source identification offers efficiency and accuracy, attracting forward-thinking automakers.

Sustainability Focus: Sustainable materials and noise reduction solutions that minimize environmental impact are gaining traction, with players developing eco-friendly noise dampening materials and optimizing production processes.

New and Emerging Trends:

EV Noise Solutions: As EV adoption accelerates, demand for specialized noise management solutions for electric motors, powertrains, and wind noise is skyrocketing, driving innovation in this segment.

Virtual Prototyping & Simulation: Advancements in virtual prototyping and simulation software are enabling faster and more efficient noise optimization, reducing the need for physical testing and development time.

Predictive Maintenance: Integrating NVH data with AI-powered predictive maintenance systems allows for proactive identification and mitigation of potential noise issues, enhancing customer satisfaction and brand reputation.

Lightweight Materials: With increasing focus on fuel efficiency, lightweight materials with strong noise dampening properties are becoming crucial, creating opportunities for innovative material developers.

Overall Competitive Scenario:

The automotive acoustic engineering services market is revving up for a fascinating race between established giants and tech-savvy disruptors. While global reach and comprehensive service portfolios provide an advantage for established players, the ability to cater to niche segments like EVs and embrace cutting-edge technologies is crucial for smaller players to gain traction. As sustainability and data-driven solutions become increasingly important, companies that prioritize R&D, invest in sustainable practices, and forge strategic partnerships with technology providers are poised to orchestrate the future symphony of silence within vehicles.

Industry Developments and Latest Updates:

Schaeffler (Germany):

- Date: December 15, 2023

- Source: Schaeffler press release

- Development: Announced a partnership with HEAD acoustics GmbH to develop AI-powered noise and vibration analysis solutions for electric vehicles.

- Details: The partnership will combine Schaeffler's expertise in electric vehicle components with HEAD acoustics' noise and vibration analysis software to create solutions that optimize EV noise and vibration, leading to a quieter and more comfortable driving experience.

IAV (Germany):

- Date: December 12, 2023

- Source: IAV website

- Development: Launched a new service called "IAV Sound Design Studio" to help automakers create customized soundscapes for electric vehicles.

- Details: The Sound Design Studio uses a combination of virtual reality and acoustic simulation tools to allow automakers to design and test different sounds for their EVs, such as acceleration, deceleration, and warning chimes. This helps create a more engaging and brand-specific driving experience for EV users.

AVL (Austria):

- Date: November 29, 2023

- Source: AVL press release

- Development: Acquired the software company SimuSitu to strengthen its capabilities in virtual testing and simulation for acoustics and vibration analysis.

- Details: The acquisition of SimuSitu will allow AVL to offer its customers more comprehensive and efficient virtual testing solutions for automotive development. This can help reduce the need for physical prototypes and accelerate the development process.

Bertrandt (Germany):

- Date: October 25, 2023

- Source: Bertrandt website

- Development: Announced a new partnership with the Fraunhofer Institute for Building Acoustics to develop noise mitigation solutions for electric vehicles.

- Details: The partnership will focus on developing lightweight and aerodynamic noise mitigation systems for EVs, which are crucial for reducing noise pollution and improving driver and passenger comfort.

Continental (Germany):

- Date: September 20, 2023

- Source: Continental press release

- Development: Unveiled a new active noise cancellation system for vehicles that uses machine learning to adapt to different driving conditions and road noises.

- Details: Continental's new active noise cancellation system can significantly reduce unwanted noise inside the vehicle, creating a quieter and more relaxing driving experience.

Top Companies in the Automotive Acoustic Engineering Services industry includes,

Schaeffler (Germany)

IAV (Germany)

AVL (Austria)

Bertrandt (Germany)

Continental (Germany)

Siemens PLM (US)

EDAG Engineering (Germany)

FEV (Germany)

HEAD acoustics GmbH (Germany)

CARCOUSTICS (Germany)

3M (US)

Autoneum (Switzerland), and others.