Automated Material Handling Size

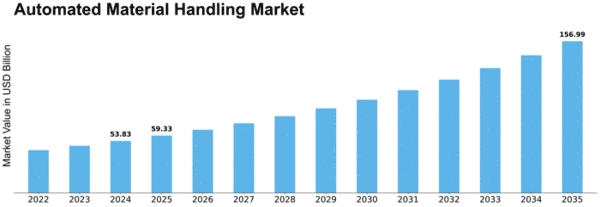

Automated Material Handling Market Growth Projections and Opportunities

There are several key factors that influence the growth and progression of Automated Material Handling (AMH) industry. This is because the market for AMH is being driven by increasing calls for easier and well-run materials handling operations in various industries. High productivity coupled with low costs can only be achieved through automation if a business seeks to maximize its profits. Another reason why enterprises invest in automatic material handling systems is to improve efficiencies levels while at the same time reducing dependence on human labor.

On the other hand, technological advancements can immensely influence AMH industry. This has led to introduction of intelligent material handling solutions which are as a result of continuous improvements in AI, sensors and robot technologies. With such integrations, automation systems become more accurate in their functions and flexible enough to meet requirements of different sectors or even industries. In order to remain competitive within this sector businesses may adopt innovative methods arising from these ongoing changes so that they are able to meet new expectations from their market.

Moreover, there has been an increase in online shopping globally leading to a tremendous impact on AMH industry. The rise of internet shopping means companies have more products to handle and deliver necessitating more warehouses as well as distribution centers across the globe. Furthermore, firms involved in online trading opt for automated material handling systems due to demand for faster order fulfillment, lesser mistakes made during packaging and delivery process resulting into greater customer satisfaction rates among consumers. Besides that, e-commerce is growing rapidly mostly in developing countries thus it continues being one of the driving forces behind AMH growth.

However, automated material handling systems are yet not widely used owing their high cost implications. Thus despite apparently high expenses associated with advanced technologies they reduce expenditure by providing better accuracy and efficiency over time. The affordability limits small-medium-sized firms (SMEs) from purchasing them as they cannot afford paying large amounts upfront. However if technology develops into standardization then prices will fall with economy scale making it affordable for more companies.

Leave a Comment