Rising Focus on Patient Safety

The rising focus on patient safety is a critical driver for the Automated Compounding System Market. As healthcare systems worldwide strive to enhance patient outcomes, the need for reliable and safe medication compounding has become paramount. Automated systems significantly reduce the risk of contamination and dosing errors, which are prevalent in manual compounding processes. Recent studies indicate that hospitals implementing automated compounding systems have reported a decrease in medication errors by up to 30%. This emphasis on safety is likely to propel the market forward, as healthcare facilities seek to adopt technologies that align with their commitment to patient care. The increasing regulatory scrutiny surrounding medication safety further underscores the necessity for automated solutions in compounding.

Integration of Advanced Technologies

The integration of advanced technologies is a pivotal driver in the Automated Compounding System Market. Innovations such as artificial intelligence, machine learning, and robotics are revolutionizing the way medications are compounded. These technologies enhance the accuracy and efficiency of compounding processes, allowing for real-time monitoring and adjustments. For instance, AI algorithms can analyze patient data to recommend optimal compounding solutions, while robotic systems can execute complex tasks with minimal human intervention. The market is expected to witness a significant increase in the adoption of these technologies, with estimates suggesting a growth rate of around 12% annually. This trend indicates a shift towards more sophisticated compounding solutions that not only improve operational efficiency but also elevate the standard of patient care.

Growing Adoption in Specialty Pharmacies

The growing adoption of automated compounding systems in specialty pharmacies is a noteworthy trend within the Automated Compounding System Market. Specialty pharmacies, which cater to patients with complex and chronic conditions, require precise and customized medication solutions. The demand for personalized compounding services is driving these pharmacies to implement automated systems that can handle intricate formulations efficiently. Market analysis indicates that the specialty pharmacy segment is expected to grow at a rate of 15% annually, as more providers recognize the benefits of automation in meeting patient needs. This trend not only enhances the operational capabilities of specialty pharmacies but also positions them to deliver higher quality care, thereby reinforcing the importance of automated compounding systems in the evolving healthcare landscape.

Cost Efficiency and Resource Optimization

Cost efficiency and resource optimization are increasingly recognized as vital drivers within the Automated Compounding System Market. As healthcare costs continue to rise, institutions are compelled to seek solutions that enhance operational efficiency while reducing expenses. Automated compounding systems streamline workflows, minimize waste, and optimize the use of resources, leading to significant cost savings. Reports suggest that facilities utilizing these systems can achieve a reduction in labor costs by approximately 20%, as automation allows for reallocating staff to more critical tasks. This financial incentive is likely to encourage more healthcare providers to invest in automated solutions, thereby expanding the market. The potential for improved profitability through enhanced efficiency positions automated compounding systems as a strategic investment for healthcare organizations.

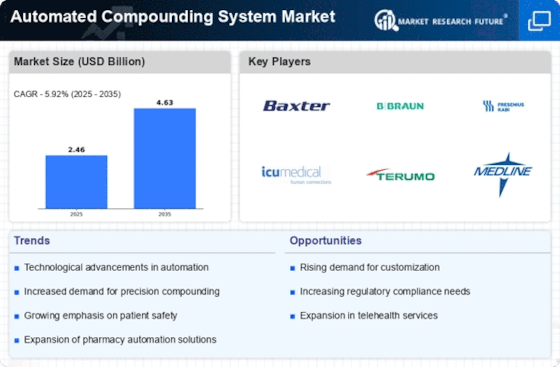

Increasing Demand for Precision in Pharmacy

The Automated Compounding System Market is experiencing a notable surge in demand for precision in pharmaceutical compounding. As healthcare providers increasingly prioritize patient safety and medication accuracy, automated systems are becoming essential. These systems minimize human error, ensuring that dosages are precise and tailored to individual patient needs. According to recent data, the market for automated compounding systems is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the need for enhanced efficiency in pharmacy operations, as well as the rising complexity of medication regimens. Consequently, the adoption of automated compounding systems is likely to become a standard practice in pharmacies, thereby transforming the landscape of pharmaceutical care.