Supportive Regulatory Frameworks

The Automated Blood Collection Market benefits from supportive regulatory frameworks that encourage the adoption of advanced blood collection technologies. Regulatory agencies are increasingly recognizing the importance of automation in enhancing the safety and efficiency of blood collection processes. Initiatives aimed at streamlining the approval process for new technologies are likely to foster innovation and investment in this sector. Furthermore, guidelines promoting the use of automated systems in clinical settings are expected to drive market growth. As regulations evolve to support technological advancements, the market could witness a surge in new product launches and increased competition among manufacturers, ultimately benefiting healthcare providers and patients alike.

Increasing Focus on Patient Safety

Patient safety remains a top priority within the Automated Blood Collection Market. The implementation of automated systems significantly reduces the risk of contamination and infection during blood collection procedures. As healthcare providers become more aware of the implications of unsafe practices, the demand for automated solutions is likely to rise. Regulatory bodies are also emphasizing the need for safer blood collection methods, which further propels market growth. Recent statistics indicate that hospitals adopting automated blood collection systems report a 25% decrease in infection rates associated with blood sampling. This focus on safety not only enhances patient trust but also aligns with broader healthcare initiatives aimed at improving quality of care.

Growing Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases is a significant driver for the Automated Blood Collection Market. Conditions such as diabetes, cardiovascular diseases, and cancer require regular blood monitoring and testing. As the patient population for these diseases expands, the demand for efficient blood collection methods rises correspondingly. Healthcare facilities are increasingly adopting automated blood collection systems to manage the higher volume of tests required for chronic disease management. Market analysis suggests that the segment related to chronic disease monitoring could see a growth rate of over 10% in the coming years. This trend underscores the necessity for healthcare systems to adapt to the changing landscape of patient care.

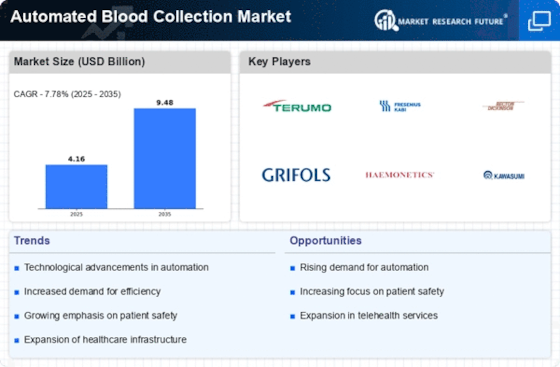

Rising Demand for Efficient Blood Collection

The Automated Blood Collection Market is experiencing a notable increase in demand for efficient blood collection methods. This trend is driven by the need for faster and more accurate blood sampling processes, which are essential in clinical settings. As healthcare facilities strive to enhance patient throughput and reduce waiting times, automated systems are becoming increasingly attractive. According to recent data, the market for automated blood collection devices is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth is indicative of a broader shift towards automation in healthcare, where efficiency and precision are paramount. The integration of automated systems not only streamlines operations but also minimizes human error, thereby improving overall patient outcomes.

Technological Innovations in Blood Collection

Technological advancements play a crucial role in shaping the Automated Blood Collection Market. Innovations such as robotic systems, advanced software, and smart devices are transforming traditional blood collection methods. These technologies enhance the accuracy and reliability of blood sampling, which is vital for diagnostic purposes. For instance, automated blood collection systems equipped with artificial intelligence can analyze samples in real-time, providing immediate feedback to healthcare professionals. The market is witnessing a surge in the adoption of these technologies, with estimates suggesting that the segment could account for over 30% of the total market share by 2026. This shift towards high-tech solutions reflects a growing recognition of the importance of precision in medical diagnostics.