Atv Parts Accessories Size

ATV Parts Accessories Market Growth Projections and Opportunities

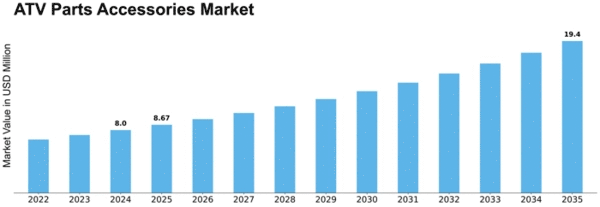

The global ATV Parts & Accessories market is in a continuous phase of growth, primarily attributed to the increasing demand for recreational activities and military operations. Additionally, the upsurge in ATV sports events is anticipated to be a driving force for the market throughout the forecast period.

The projected compound annual growth rate (CAGR) for the global ATV Parts & Accessories market during the forecast period from 2023 to 2030 is estimated at 4.1%. As of 2022, North America dominated this market, holding a substantial 69.7% share, followed by Europe with an 18.3% share. Notably, developing countries such as India and China are poised to showcase significant growth in the forecast period.

The market segmentation is based on various factors, including type, product type, distribution channel, end-use, propulsion type, and region. Regarding type, the global ATV Parts & Accessories market is divided into Sports and Utility. The utility segment, accounting for 54.2% share in 2022, is anticipated to grow at a rate of 4.3% during the forecast period.

In terms of product type, the market distinguishes between ATV Parts and ATV Accessories. The parts segment, which held a considerable 90.9% share in 2022, is expected to exhibit a growth rate of 3.7% throughout the forecast period.

The distribution channel is another crucial aspect of the market segmentation, categorized into Brick & Mortar Stores, E-commerce Marketplaces, Direct-to-Consumer, and Online Retailer. The e-commerce marketplace segment is anticipated to experience substantial growth, securing a 43.4% share in 2022.

End-use is a pivotal factor in market classification, differentiating between OEM and aftermarket segments. The OEM segment, with a 67.7% share in 2022, is projected to grow at a rate of 3.6% during the forecast period.

The segmentation based on propulsion type includes ICE (Internal Combustion Engine) and Electric. The ICE segment, holding a noteworthy 90.9% share in 2022, is expected to witness significant growth throughout the forecast period. the global ATV Parts & Accessories market is on a trajectory of sustained growth, fueled by the escalating demand for recreational activities, military operations, and the increasing popularity of ATV sports events. The market's comprehensive segmentation based on type, product type, distribution channel, end-use, and propulsion type reflects the diverse factors influencing its expansion. As the industry evolves, with a focus on technological advancements and changing consumer preferences, the market is poised to witness dynamic developments, particularly in emerging economies like India and China.

Leave a Comment