Growing Geriatric Population

The expanding geriatric population is a crucial driver for the Atrial Appendage Occluder Market. As individuals age, the risk of developing atrial fibrillation and related cardiovascular conditions increases significantly. This demographic shift is expected to result in a higher demand for atrial appendage occluders, as older adults are more susceptible to strokes and other complications associated with AF. Projections indicate that by 2050, the number of people aged 65 and older will double, further intensifying the need for effective treatment options. Consequently, the Atrial Appendage Occluder Market is likely to benefit from this demographic trend, as healthcare systems adapt to meet the needs of an aging population.

Supportive Regulatory Frameworks

The presence of supportive regulatory frameworks is a significant driver for the Atrial Appendage Occluder Market. Regulatory bodies are increasingly recognizing the importance of these devices in stroke prevention, leading to streamlined approval processes and enhanced market access. For instance, expedited pathways for device approval have been established, allowing manufacturers to bring innovative products to market more quickly. This regulatory support not only encourages investment in research and development but also fosters competition among manufacturers, ultimately benefiting patients. As regulatory environments continue to evolve favorably, the Atrial Appendage Occluder Market is likely to experience accelerated growth, driven by the introduction of new and improved devices.

Rising Awareness and Education Initiatives

Increased awareness regarding the risks associated with atrial fibrillation and the benefits of atrial appendage occlusion is driving the Atrial Appendage Occluder Market. Educational campaigns by healthcare organizations and advocacy groups are informing both patients and healthcare professionals about the importance of stroke prevention strategies. This heightened awareness is likely to lead to earlier diagnosis and treatment, thereby increasing the demand for atrial appendage occluders. Furthermore, as more patients become informed about their treatment options, the market is expected to witness a surge in adoption rates. The proactive approach to education and awareness is thus a crucial factor in shaping the future of the Atrial Appendage Occluder Market.

Technological Innovations in Device Design

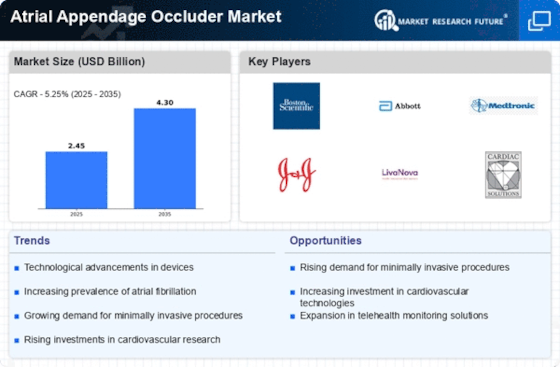

Technological advancements in the design and functionality of atrial appendage occluders are significantly influencing the Atrial Appendage Occluder Market. Innovations such as improved materials, enhanced delivery systems, and minimally invasive procedures are making these devices more effective and safer for patients. For instance, the development of bioresorbable materials and advanced imaging techniques has led to better patient outcomes and reduced complications. As these technologies evolve, they are likely to attract more healthcare providers and patients, thereby expanding the market. The integration of digital health technologies, such as remote monitoring, further enhances the appeal of these devices, suggesting a promising trajectory for the Atrial Appendage Occluder Market.

Increasing Incidence of Atrial Fibrillation

The rising prevalence of atrial fibrillation (AF) is a primary driver for the Atrial Appendage Occluder Market. AF affects millions worldwide, leading to a heightened risk of stroke. As the population ages, the incidence of AF is expected to increase, thereby amplifying the demand for effective treatment options. According to recent estimates, approximately 33 million individuals are living with AF, which underscores the urgent need for innovative solutions like atrial appendage occluders. This growing patient base is likely to propel market growth, as healthcare providers seek to mitigate the risks associated with AF. Consequently, the Atrial Appendage Occluder Market is poised for expansion, driven by the need to address this escalating health concern.