Increased Awareness and Education

The growing awareness and education surrounding atrial fibrillation are pivotal in driving the Atrial Fibrillation Market. Public health campaigns and educational initiatives aimed at both healthcare professionals and patients have significantly improved understanding of AF, its risk factors, and potential complications. This heightened awareness encourages individuals to seek medical attention sooner, leading to earlier diagnosis and treatment. Moreover, healthcare providers are increasingly emphasizing the importance of patient education in managing AF, which can lead to better adherence to treatment plans. As awareness continues to rise, the demand for AF-related products and services is expected to grow, further stimulating the Atrial Fibrillation Market.

Advancements in Medical Technology

Technological innovations play a crucial role in shaping the Atrial Fibrillation Market. Recent advancements in medical devices, such as catheter ablation systems and implantable cardioverter-defibrillators (ICDs), have significantly improved treatment outcomes for patients with AF. These technologies enable more precise and less invasive procedures, which are increasingly preferred by both patients and healthcare providers. Furthermore, the integration of telemedicine and remote monitoring solutions has enhanced patient management, allowing for timely interventions and better adherence to treatment protocols. As these technologies continue to evolve, they are expected to drive growth in the Atrial Fibrillation Market, providing new opportunities for manufacturers and healthcare providers alike.

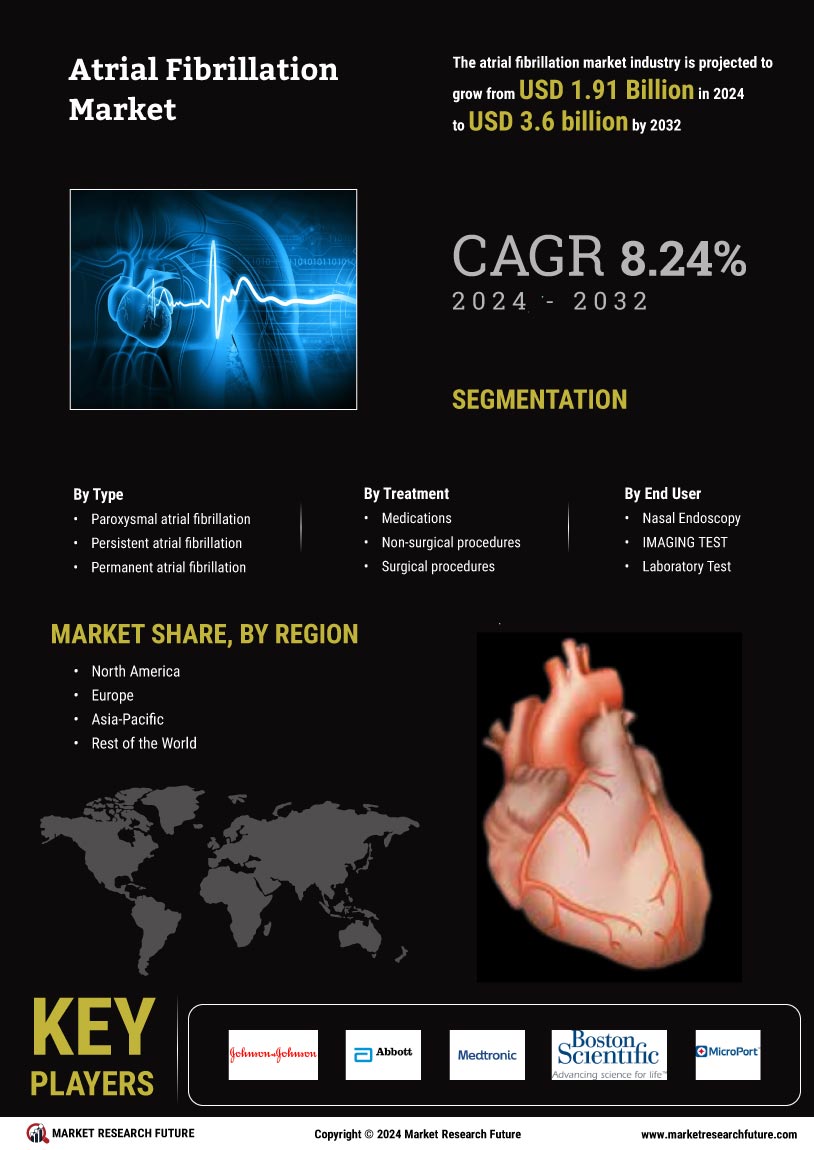

Rising Prevalence of Atrial Fibrillation

The increasing prevalence of atrial fibrillation (AF) is a primary driver of the Atrial Fibrillation Market. It is estimated that approximately 33.5 million individuals are affected by AF worldwide. This condition is often associated with aging populations, as the risk of developing AF escalates with age. The growing number of elderly individuals, who are more susceptible to cardiovascular diseases, contributes to the rising incidence of AF. Consequently, healthcare systems are compelled to enhance their focus on AF management, leading to a surge in demand for diagnostic tools and treatment options. This trend is likely to continue, as projections indicate that the number of individuals with AF could double by 2050, further propelling the Atrial Fibrillation Market.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are essential drivers of the Atrial Fibrillation Market. Governments and regulatory bodies are increasingly recognizing the importance of effective AF management and are implementing policies that facilitate access to innovative treatments. This includes streamlined approval processes for new medical devices and therapies, as well as reimbursement frameworks that support the financial viability of AF treatments. Such policies not only encourage research and development in the Atrial Fibrillation Market but also enhance patient access to necessary care. As these supportive measures continue to evolve, they are likely to foster growth and innovation within the industry.

Growing Investment in Healthcare Infrastructure

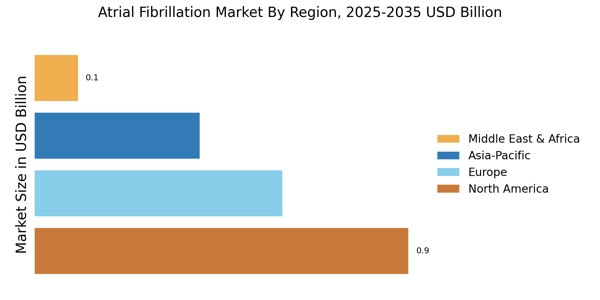

Investment in healthcare infrastructure is a significant driver of the Atrial Fibrillation Market. Governments and private entities are increasingly allocating resources to improve healthcare facilities and expand access to advanced medical technologies. This trend is particularly evident in emerging economies, where the demand for quality healthcare services is on the rise. Enhanced healthcare infrastructure facilitates the early diagnosis and effective management of atrial fibrillation, leading to better patient outcomes. Additionally, the establishment of specialized cardiac care centers is likely to contribute to the growth of the Atrial Fibrillation Market, as these centers focus on providing comprehensive care for patients with AF.