Market Analysis

In-depth Analysis of Asia Pacific Wearable Medical Device Market Industry Landscape

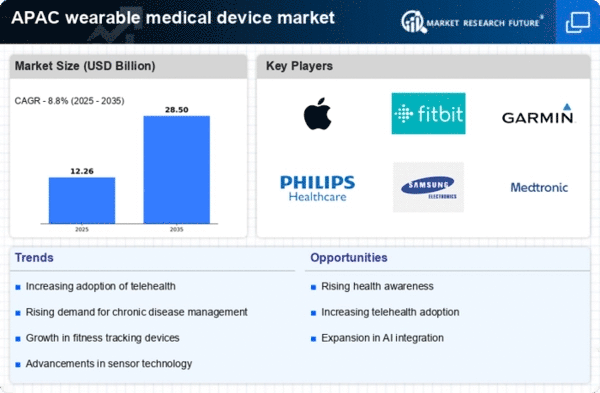

It's becoming apparent that staying healthy and fit is important, so the market is growing quickly. What's speeding up the business's growth? Increasing numbers of consumers are interested in using smart technology to find out about their health right away. These are the important things that are making the company grow. People in the Asia-Pacific area are getting long-term sicknesses more and more often. This means that more people need medical gear that they can wear. People who have diabetes and heart disease want to keep track of their health problems. Because of this, technology that could be put on the body was created. Short-lived technological advances have an effect on how markets work. These days, sensor technology, networking, and data processing have come a long way. This has caused more people to use smart medical devices. Because of these improvements, people can now get health information that is not only more correct but also more useful. It's possible that the market grew because the government worked to improve patient results and technology in the healthcare business. A lot of Asian Pacific countries are putting money into their health care systems and telling their people to stay healthy by using smart tech. More people in the region wear medical gadgets because they are living longer. There are more and more old people, so they should get regular checkups. Smart technology could be helpful for both patients and medical workers, and it could be easy to use. More and more people are using fitness trackers that you wear. This might be happening because people in this area are interested in health and sports more. The market for these tools is growing because people who are concerned about their health and younger people are both becoming more interested in them. Because of the COVID-19 outbreak, more patients are being treated by having their conditions watched from afar. These factors have directly led to a big growth in the market for medical gear that can be worn. Wearable gadgets are becoming more and more popular among people, including patients and medical workers. With this technology, people can look at their health info from afar without having to call their doctors. There are a lot of links between people who work in healthcare and companies that make technology. Through this relationship, the creation of smarter and more connected personal medical gadgets is pushed, which will eventually lead to a more all-around approach to managing healthcare. There are worries about the safety and security of data, which is changing the business, even though the market's growth is overall positive. To make sure the business grows, it is important to deal with these problems and put in place good protection measures. This is necessary because smart devices can get important health information, and these issues need to be fixed right away. In the Asia Pacific Wearable Medical Device Market, several firms operate. This category includes healthcare giants, IT giants, and startups. Variety encourages innovation and competition, creating a dynamic market.

Leave a Comment