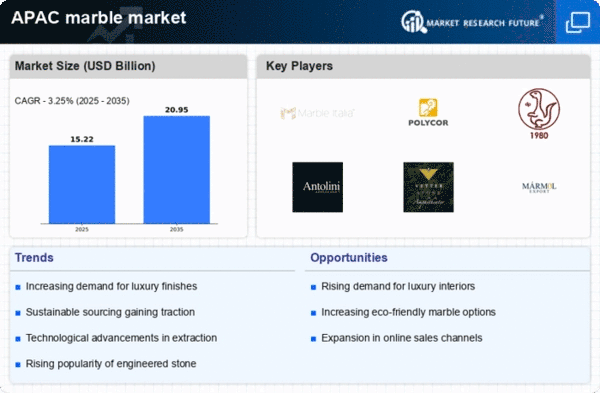

China : Unmatched Demand and Supply Dynamics

Key markets include cities like Beijing, Shanghai, and Guangzhou, where luxury developments are prevalent. The competitive landscape features major players like Antolini and Polycor, alongside local manufacturers. The business environment is robust, supported by favorable trade policies and investment in technology. Marble finds applications in architecture, interior design, and public infrastructure, solidifying its position in the market.

India : Growing Demand in Construction Sector

Significant markets include Rajasthan, Gujarat, and Maharashtra, known for their marble production and consumption. The competitive landscape features local players like Dimpomar and international firms. The business environment is improving, with investments in technology and infrastructure. Marble is widely used in flooring, countertops, and decorative elements, catering to both residential and commercial sectors.

Japan : Cultural Influence on Marble Usage

Key markets include Tokyo, Osaka, and Yokohama, where luxury and traditional architecture coexist. The competitive landscape features both local artisans and international players like Antolini. The business environment is characterized by high standards and consumer expectations. Marble is primarily used in residential projects, temples, and public buildings, reflecting Japan's cultural heritage and modern aesthetics.

South Korea : Luxury Segment on the Rise

Key markets include Seoul and Busan, where luxury developments are prominent. The competitive landscape features both domestic and international players, including Vetter Stone. The business environment is dynamic, with a focus on design and quality. Marble is extensively used in luxury homes, hotels, and commercial spaces, aligning with consumer preferences for elegance and sophistication.

Malaysia : Emerging Demand in Construction

Key markets include Kuala Lumpur and Penang, where construction activities are booming. The competitive landscape features local players and international firms like Marmol Export. The business environment is evolving, with investments in technology and quality assurance. Marble is used in flooring, countertops, and decorative elements, catering to both residential and commercial sectors.

Thailand : Cultural Heritage Influences Market

Key markets include Bangkok and Chiang Mai, where luxury developments are prevalent. The competitive landscape features local manufacturers and international players. The business environment is favorable, with a focus on quality and design. Marble is widely used in hospitality, residential, and cultural projects, reflecting Thailand's rich heritage and modern architecture.

Indonesia : Construction Boom Fuels Demand

Key markets include Jakarta and Surabaya, where construction is booming. The competitive landscape features local players and international firms. The business environment is improving, with investments in technology and quality control. Marble is used in residential, commercial, and public projects, catering to the growing demand for premium materials.

Rest of APAC : Varied Demand Across Sub-regions

Key markets include emerging economies in Southeast Asia and the Pacific Islands. The competitive landscape features a mix of local and international players. The business environment varies significantly, influenced by local regulations and market conditions. Marble is used in various applications, from residential to commercial, reflecting the unique needs of each sub-region.