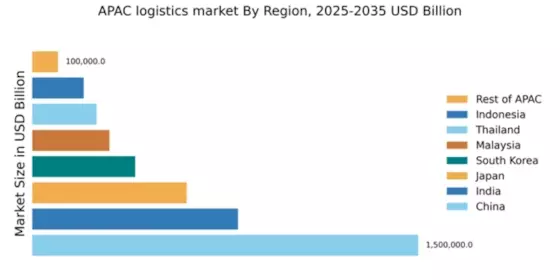

China : Unmatched Scale and Growth Potential

Key markets include major cities like Shanghai, Beijing, and Shenzhen, which are logistics hotspots. The competitive landscape features significant players such as DHL, FedEx, and local giants like SF Express. The business environment is dynamic, with a focus on technology adoption and sustainability. Industries such as e-commerce, manufacturing, and retail are driving demand for logistics services, making China a critical player in the global supply chain.

India : E-commerce Fuels Demand Surge

Key markets include metropolitan areas like Mumbai, Delhi, and Bengaluru, which are logistics hubs. The competitive landscape features major players like DHL, Blue Dart, and local firms such as Delhivery. The business environment is characterized by a mix of traditional and tech-driven logistics solutions. Sectors like retail, pharmaceuticals, and automotive are significant contributors to logistics demand, reflecting India's diverse economic landscape.

Japan : Technology-Driven Market Dynamics

Key markets include Tokyo, Osaka, and Nagoya, which are central to logistics operations. The competitive landscape features major players like Nippon Express and Yamato Holdings, alongside global firms like UPS. The business environment is stable, with a focus on quality and reliability. Industries such as automotive, electronics, and retail are significant, driving demand for sophisticated logistics solutions.

South Korea : Strong Infrastructure and Connectivity

Key markets include Seoul, Busan, and Incheon, which are vital for logistics operations. The competitive landscape features major players like CJ Logistics and Hanjin Transportation, along with international firms like FedEx. The business environment is competitive, with a focus on innovation and service quality. Sectors such as electronics, automotive, and retail are key drivers of logistics demand, reflecting South Korea's industrial strengths.

Malaysia : Strategic Location and Growth Potential

Key markets include Kuala Lumpur, Penang, and Johor, which are central to logistics activities. The competitive landscape features players like Pos Malaysia and GD Express, alongside international firms like DHL. The business environment is evolving, with a focus on digital transformation and sustainability. Industries such as manufacturing, retail, and agriculture are significant contributors to logistics demand, reflecting Malaysia's diverse economy.

Thailand : Key Player in ASEAN Logistics

Key markets include Bangkok, Chiang Mai, and Chonburi, which are vital for logistics operations. The competitive landscape features major players like SCG Logistics and Kerry Logistics, alongside international firms like UPS. The business environment is dynamic, with a focus on technology adoption and service quality. Sectors such as retail, automotive, and food and beverage are significant drivers of logistics demand, reflecting Thailand's economic diversity.

Indonesia : Growth Driven by Infrastructure Development

Key markets include Jakarta, Surabaya, and Bandung, which are central to logistics activities. The competitive landscape features players like JNE and Tiki, alongside international firms like DHL. The business environment is challenging but improving, with a focus on technology and service quality. Sectors such as e-commerce, manufacturing, and agriculture are significant contributors to logistics demand, reflecting Indonesia's diverse economy.

Rest of APAC : Emerging Markets and Growth Potential

Key markets include Vietnam, Philippines, and Singapore, which are vital for logistics operations. The competitive landscape features local players and international firms like Maersk and DB Schenker. The business environment is diverse, with varying levels of development and regulatory support. Sectors such as retail, manufacturing, and agriculture are significant drivers of logistics demand, reflecting the region's economic diversity.