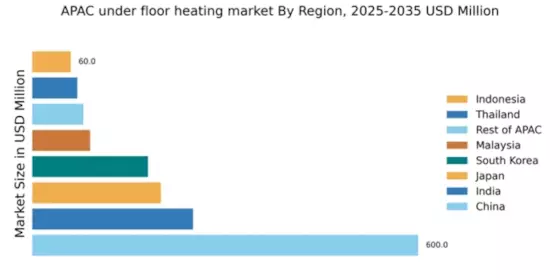

China : Rapid Growth and Urbanization Trends

China holds a commanding market share of 600.0 million, accounting for a significant portion of the APAC under floor heating market. Key growth drivers include rapid urbanization, increasing disposable incomes, and a growing preference for energy-efficient heating solutions. Government initiatives promoting green building practices and energy conservation are also pivotal. The construction sector's expansion, particularly in residential and commercial buildings, further fuels demand for under floor heating systems.

India : Growing Demand in Urban Areas

India's under floor heating market is valued at 250.0 million, driven by urbanization and rising living standards. The demand for energy-efficient heating solutions is increasing, particularly in metropolitan areas. Government policies supporting sustainable construction and energy efficiency are enhancing market growth. The rise in infrastructure projects, including smart cities, is also contributing to the demand for advanced heating technologies.

Japan : Focus on Energy Efficiency

Japan's market for under floor heating is valued at 200.0 million, characterized by a strong emphasis on energy efficiency and innovative technologies. The aging population and increasing demand for comfort heating in residential spaces are key growth drivers. Government regulations promoting energy-efficient systems and smart home technologies are also influential. The market is witnessing a shift towards sustainable heating solutions, aligning with national energy policies.

South Korea : Smart Technologies Driving Growth

South Korea's under floor heating market is valued at 180.0 million, supported by technological advancements and a focus on smart home solutions. The demand for energy-efficient heating systems is rising, driven by government initiatives aimed at reducing carbon emissions. Urban development projects and a growing middle class are also contributing to market growth. The competitive landscape features both local and international players offering innovative products.

Malaysia : Urbanization Fuels Market Growth

Malaysia's under floor heating market is valued at 90.0 million, with urbanization and rising living standards driving demand. The increasing focus on energy efficiency and sustainable building practices is influencing consumer preferences. Government initiatives promoting green technology adoption are also significant. Key markets include Kuala Lumpur and Penang, where infrastructure development is robust, creating opportunities for under floor heating solutions.

Thailand : Focus on Residential and Commercial Sectors

Thailand's under floor heating market is valued at 70.0 million, with growth driven by increasing urbanization and a rising demand for comfort heating. The residential sector is a major contributor, alongside commercial applications in hotels and offices. Government policies supporting energy efficiency and sustainable construction are enhancing market dynamics. Key cities like Bangkok and Chiang Mai are pivotal markets for under floor heating solutions.

Indonesia : Rising Demand in Urban Centers

Indonesia's under floor heating market is valued at 60.0 million, with significant growth potential driven by urbanization and increasing disposable incomes. The demand for modern heating solutions is rising, particularly in major cities like Jakarta and Surabaya. Government initiatives promoting energy efficiency and sustainable building practices are also influencing market dynamics. The competitive landscape is evolving, with both local and international players entering the market.

Rest of APAC : Regional Growth Opportunities

The Rest of APAC market for under floor heating is valued at 79.5 million, characterized by diverse demand across various countries. Growth is driven by increasing urbanization and a shift towards energy-efficient heating solutions. Government policies promoting sustainable construction practices are also significant. Key markets include Vietnam and the Philippines, where infrastructure development is creating opportunities for under floor heating systems.