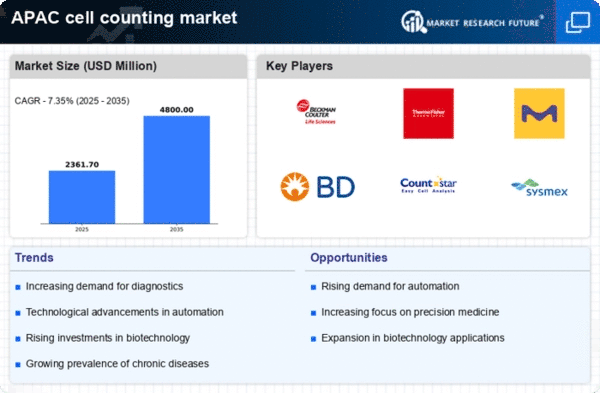

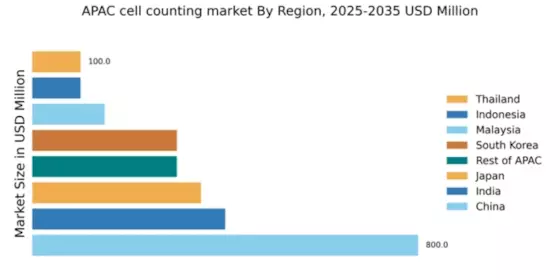

China : Unmatched Growth and Innovation

Key markets include Beijing, Shanghai, and Shenzhen, where major players like Beckman Coulter and Countstar have established a strong presence. The competitive landscape is characterized by a mix of local and international firms, fostering innovation and price competition. The business environment is favorable, with supportive policies for R&D in life sciences. Applications span across pharmaceuticals, diagnostics, and academic research, driving sustained demand for advanced cell counting solutions.

India : Rapid Growth in Healthcare Sector

Key markets include Mumbai, Delhi, and Bangalore, where a mix of domestic and international players like Becton Dickinson and Thermo Fisher Scientific are competing. The competitive landscape is vibrant, with local startups emerging alongside established firms. The business environment is improving, supported by favorable policies and funding for healthcare innovation. Applications in pharmaceuticals, diagnostics, and academic research are driving demand for cell counting technologies.

Japan : Innovation and Quality at Forefront

Key markets include Tokyo, Osaka, and Yokohama, where major players like Sysmex Corporation and Merck KGaA dominate. The competitive landscape is characterized by high-quality standards and a focus on technological advancements. The business environment is stable, with strong support for R&D initiatives. Applications in clinical diagnostics, pharmaceuticals, and regenerative medicine are significant, driving the need for precise cell counting technologies.

South Korea : Healthcare Innovation Driving Demand

Key markets include Seoul, Busan, and Incheon, where major players like Becton Dickinson and Bio-Rad Laboratories have a significant presence. The competitive landscape is robust, with both local and international firms vying for market share. The business environment is favorable, supported by government policies promoting R&D and innovation. Applications in clinical diagnostics, pharmaceuticals, and research institutions are driving demand for cell counting solutions.

Malaysia : Investment in Healthcare Infrastructure

Key markets include Kuala Lumpur, Penang, and Johor Bahru, where players like Thermo Fisher Scientific and Nexcelom Bioscience are establishing a foothold. The competitive landscape is evolving, with both local and international firms competing for market share. The business environment is improving, supported by government policies promoting healthcare innovation. Applications in diagnostics, pharmaceuticals, and research are driving demand for cell counting technologies.

Thailand : Healthcare Sector on the Rise

Key markets include Bangkok, Chiang Mai, and Phuket, where players like Beckman Coulter and Bio-Rad Laboratories are establishing a presence. The competitive landscape is characterized by a mix of local and international firms, fostering innovation and price competition. The business environment is improving, supported by favorable policies for healthcare innovation. Applications in diagnostics, pharmaceuticals, and academic research are driving demand for cell counting solutions.

Indonesia : Investments in Healthcare Infrastructure

Key markets include Jakarta, Surabaya, and Bandung, where players like Thermo Fisher Scientific and Countstar are establishing a foothold. The competitive landscape is evolving, with both local and international firms competing for market share. The business environment is improving, supported by government policies promoting healthcare innovation. Applications in diagnostics, pharmaceuticals, and research are driving demand for cell counting technologies.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include Singapore, Ho Chi Minh City, and Manila, where players like Beckman Coulter and Merck KGaA are establishing a presence. The competitive landscape is characterized by a mix of local and international firms, fostering innovation and price competition. The business environment varies significantly across countries, influenced by local policies and economic conditions. Applications in diagnostics, pharmaceuticals, and academic research are driving demand for cell counting solutions.