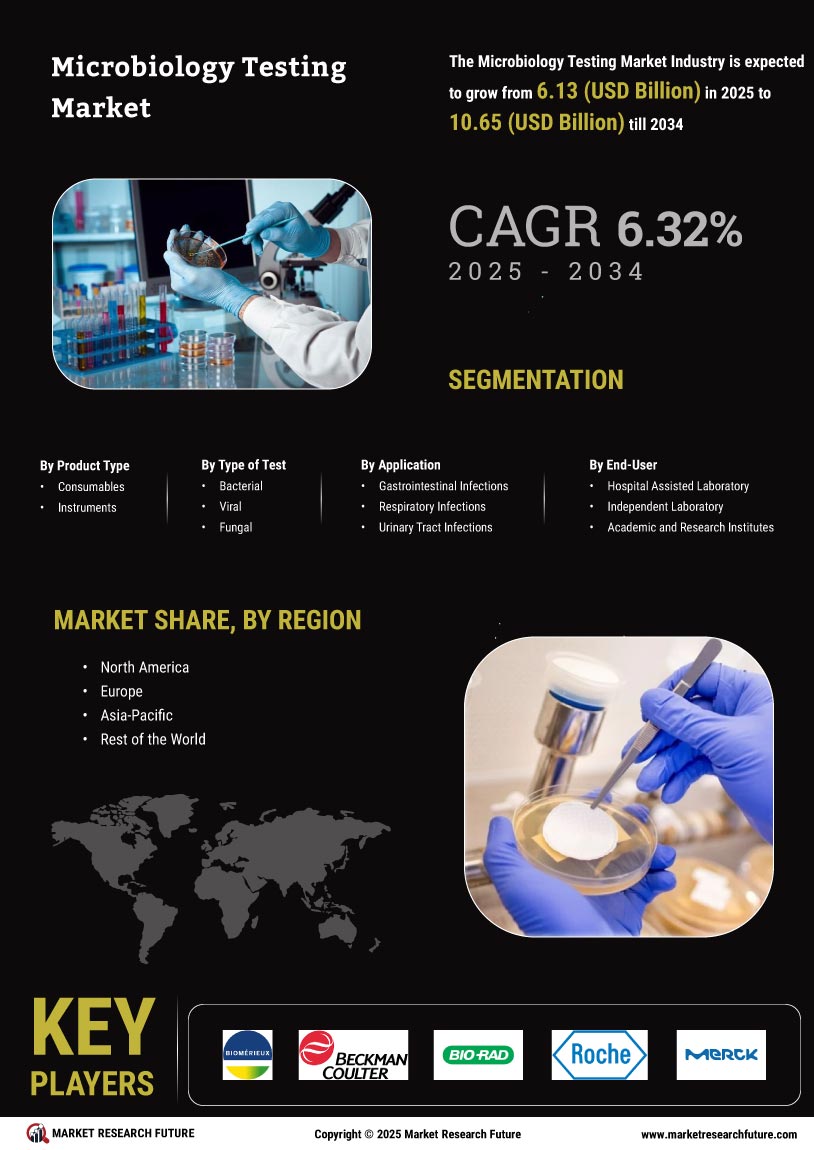

Market Growth Projections

The Global Microbiology Testing Market Industry is projected to experience substantial growth in the coming years. With a market value of 6.16 USD Billion in 2024, it is anticipated to reach 10.2 USD Billion by 2035, reflecting a robust CAGR of 4.69% from 2025 to 2035. This growth is driven by various factors, including technological advancements, increased regulatory scrutiny, and rising awareness of health and safety standards across multiple sectors. The expanding applications of microbiological testing in pharmaceuticals, food safety, and clinical diagnostics further underscore the market's potential for development.

Increased Government Regulations

Government regulations aimed at protecting public health are a significant driver of the Global Microbiology Testing Market Industry. Agencies worldwide are implementing stringent guidelines for microbiological testing across various sectors, including healthcare, food, and pharmaceuticals. For example, the FDA and the European Medicines Agency enforce rigorous testing protocols to ensure product safety. This regulatory landscape compels industries to invest in microbiological testing to comply with legal requirements. As a result, the market is expected to witness substantial growth, reflecting the critical role of regulatory compliance in driving testing demand.

Rising Demand for Food Safety Testing

The increasing global focus on food safety is a primary driver for the Global Microbiology Testing Market Industry. With foodborne illnesses affecting millions annually, regulatory bodies are enforcing stricter safety standards. For instance, the World Health Organization reports that unsafe food causes 600 million illnesses worldwide each year. This heightened awareness is prompting food manufacturers to adopt microbiological testing to ensure compliance and safeguard consumer health. The market is projected to reach 6.16 USD Billion in 2024, reflecting the growing need for reliable testing methods in the food sector.

Expansion of Pharmaceutical Applications

The pharmaceutical industry is experiencing significant growth, which is positively influencing the Global Microbiology Testing Market Industry. As new drugs and biologics are developed, the need for rigorous microbiological testing to ensure product safety and efficacy becomes paramount. Regulatory agencies, such as the FDA, mandate extensive testing protocols for microbial contamination. This trend is expected to contribute to the market's expansion, with projections indicating a rise to 10.2 USD Billion by 2035. The increasing complexity of drug formulations necessitates advanced microbiological testing techniques, thereby driving market growth.

Technological Advancements in Testing Methods

Innovations in microbiological testing technologies are transforming the Global Microbiology Testing Market Industry. Techniques such as PCR, next-generation sequencing, and rapid testing methods are enhancing the accuracy and speed of microbial detection. These advancements not only improve laboratory efficiency but also reduce time-to-results, which is crucial in clinical and food safety applications. The integration of automation and artificial intelligence in testing processes further streamlines operations. As a result, the market is anticipated to grow at a CAGR of 4.69% from 2025 to 2035, driven by the demand for more sophisticated testing solutions.

Growing Awareness of Healthcare-Associated Infections

The rising awareness of healthcare-associated infections (HAIs) is influencing the Global Microbiology Testing Market Industry. Hospitals and healthcare facilities are increasingly prioritizing infection control measures to mitigate the spread of HAIs, which affect millions of patients globally. The implementation of microbiological testing protocols is essential for monitoring and preventing infections. This trend is further supported by initiatives from health organizations advocating for improved hygiene practices. Consequently, the market is poised for growth as healthcare providers recognize the importance of microbiological testing in safeguarding patient health.