Shift Towards Single-Use Systems

The Aseptic Transfer System Market is witnessing a notable shift towards single-use systems, which offer numerous advantages over traditional multi-use systems. Single-use technologies reduce the risk of cross-contamination and eliminate the need for extensive cleaning and sterilization processes. This trend is particularly relevant in the biopharmaceutical sector, where the demand for flexibility and efficiency is paramount. Market data indicates that the single-use systems segment is expected to capture a substantial share of the aseptic transfer system market, with projections suggesting a growth rate of around 15% annually. This shift is driven by the increasing preference for modular and scalable manufacturing solutions that can adapt to varying production needs, thereby enhancing operational efficiency and reducing time-to-market.

Increasing Focus on Sustainability

The Aseptic Transfer System Market is also experiencing a growing emphasis on sustainability and environmentally friendly practices. As manufacturers strive to reduce their carbon footprint and minimize waste, there is a rising interest in aseptic transfer systems that incorporate sustainable materials and processes. This trend aligns with the broader industry movement towards green manufacturing, which seeks to balance operational efficiency with environmental responsibility. Market analysts suggest that systems designed with sustainability in mind may gain a competitive advantage, as stakeholders increasingly prioritize eco-friendly solutions. The integration of sustainable practices in aseptic transfer systems not only addresses environmental concerns but also appeals to a conscientious consumer base, potentially driving market growth in the coming years.

Rising Demand for Biopharmaceuticals

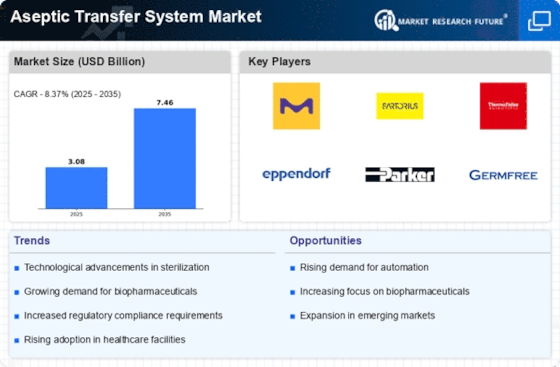

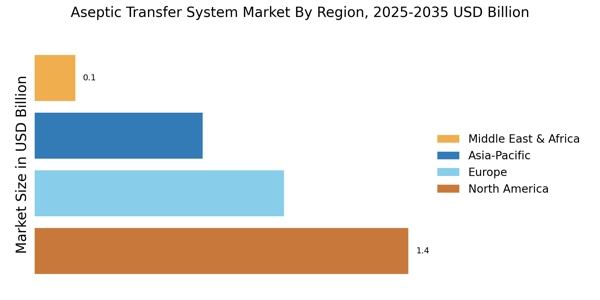

The Aseptic Transfer System Market is significantly influenced by the rising demand for biopharmaceuticals, which require stringent aseptic conditions during production. As the biopharmaceutical sector expands, driven by the need for innovative therapies and personalized medicine, the demand for aseptic transfer systems is expected to increase correspondingly. The market is projected to reach a valuation of several billion dollars by the end of the decade, reflecting the growing investment in biopharmaceutical manufacturing capabilities. This trend is further supported by the increasing prevalence of chronic diseases and the aging population, which necessitate the development of new biologics and vaccines. Consequently, the need for reliable and efficient aseptic transfer systems becomes paramount to ensure product integrity and patient safety.

Regulatory Compliance and Quality Assurance

The Aseptic Transfer System Market is heavily influenced by the stringent regulatory requirements imposed by health authorities worldwide. Compliance with Good Manufacturing Practices (GMP) and other quality assurance standards is essential for pharmaceutical manufacturers. As regulatory bodies continue to enforce rigorous guidelines, the demand for aseptic transfer systems that ensure compliance is likely to rise. Companies are increasingly investing in advanced aseptic technologies to meet these standards, which may lead to a market expansion. The emphasis on quality assurance not only safeguards product integrity but also enhances consumer trust in biopharmaceutical products. This focus on compliance is expected to drive innovation and investment in the aseptic transfer system market, as manufacturers seek to maintain their competitive edge.

Technological Advancements in Aseptic Transfer Systems

The Aseptic Transfer System Market is experiencing a surge in technological advancements that enhance the efficiency and safety of aseptic processes. Innovations such as automated aseptic transfer systems and advanced sterilization techniques are being integrated into manufacturing processes. These advancements not only improve product quality but also reduce the risk of contamination, which is critical in pharmaceutical and biopharmaceutical production. The market for aseptic transfer systems is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. This growth is driven by the increasing adoption of automation and digital technologies in aseptic processing, which streamline operations and ensure compliance with stringent regulatory standards.