Stringent Regulatory Frameworks

The Aseptic Sampling Market is significantly influenced by the stringent regulatory frameworks governing the pharmaceutical and biotechnology sectors. Regulatory bodies are imposing rigorous standards for product quality and safety, necessitating the implementation of aseptic sampling methods to ensure compliance. For instance, the FDA and EMA have established guidelines that mandate the use of validated aseptic techniques in the manufacturing process. This regulatory pressure is driving companies to invest in aseptic sampling solutions, as non-compliance can result in severe penalties and product recalls. Consequently, the Aseptic Sampling Market is likely to see sustained growth as organizations prioritize adherence to these regulations.

Rising Demand for Biopharmaceuticals

The Aseptic Sampling Market is experiencing a notable surge in demand due to the increasing production of biopharmaceuticals. As the biopharmaceutical sector expands, the need for reliable and contamination-free sampling methods becomes paramount. According to recent data, the biopharmaceutical market is projected to reach USD 500 billion by 2026, which indicates a robust growth trajectory. This growth is likely to drive the adoption of aseptic sampling techniques, as manufacturers seek to ensure product integrity and compliance with stringent quality standards. The Aseptic Sampling Market is thus positioned to benefit from this trend, as companies invest in advanced sampling technologies to meet the evolving needs of biopharmaceutical production.

Growing Investment in Research and Development

Investment in research and development is a key driver for the Aseptic Sampling Market. As pharmaceutical and biotechnology companies strive to innovate and improve their product offerings, there is a corresponding need for advanced sampling techniques that ensure quality and safety. Increased R&D spending, which is projected to reach USD 200 billion by 2025 in the pharmaceutical sector, is likely to fuel demand for aseptic sampling solutions. This investment not only supports the development of new products but also enhances existing processes, thereby driving growth in the Aseptic Sampling Market. Companies that prioritize R&D are expected to gain a competitive edge, further propelling market expansion.

Increased Focus on Environmental Sustainability

The Aseptic Sampling Market is also witnessing a shift towards environmentally sustainable practices. As companies become more aware of their environmental impact, there is a growing emphasis on adopting eco-friendly sampling methods. This trend is particularly relevant in the context of aseptic sampling, where traditional methods may generate significant waste. Innovations in sustainable materials and processes are emerging, allowing for the development of aseptic sampling solutions that minimize environmental footprints. The market is expected to respond positively to this shift, as organizations seek to align their operations with sustainability goals while maintaining compliance with industry standards.

Technological Innovations in Sampling Techniques

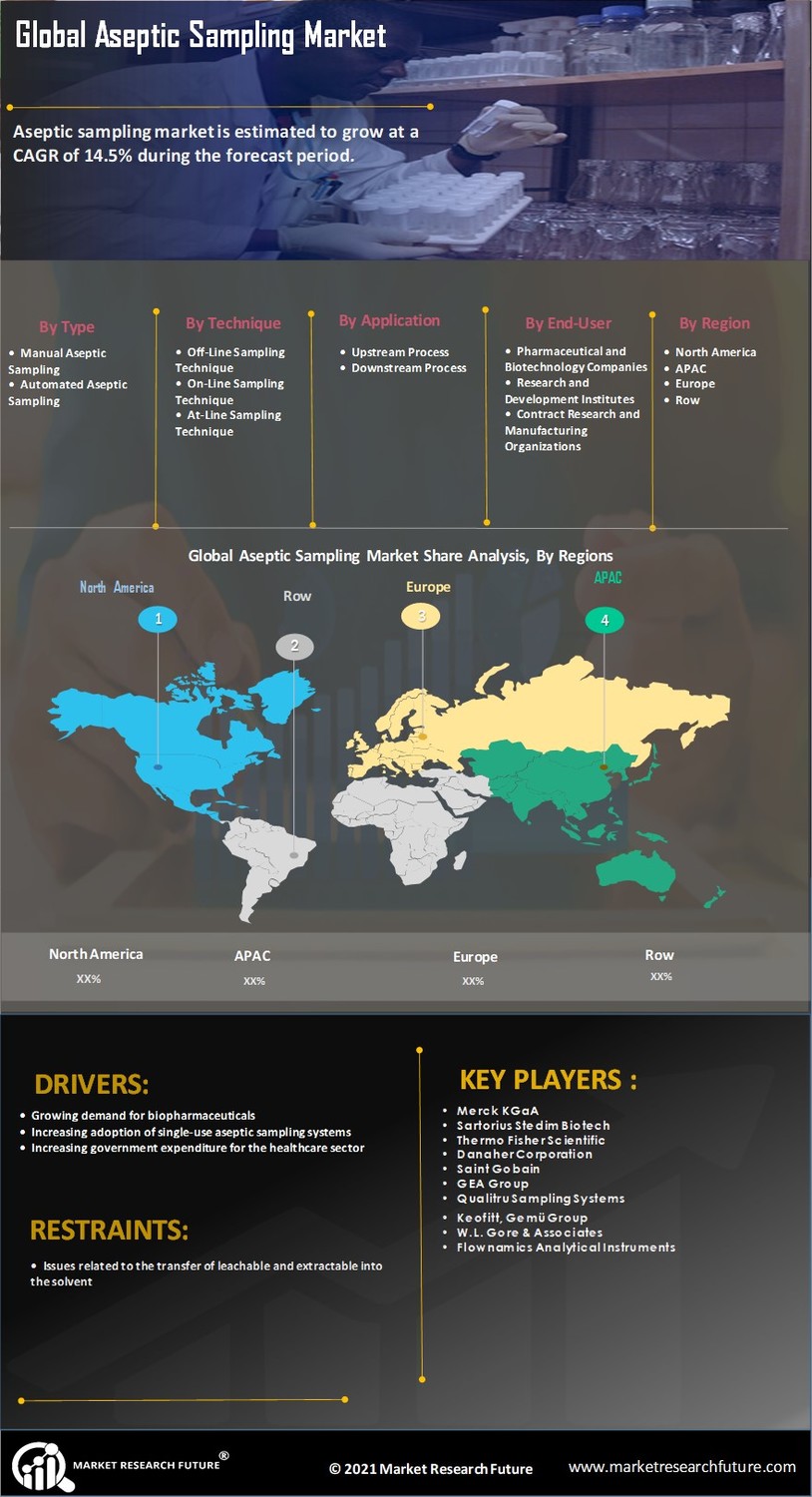

Technological advancements are playing a crucial role in shaping the Aseptic Sampling Market. Innovations such as automated sampling systems and advanced filtration technologies are enhancing the efficiency and reliability of aseptic sampling processes. These innovations not only reduce the risk of contamination but also streamline operations, thereby improving overall productivity. The market for automated aseptic sampling systems is expected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. As companies increasingly adopt these technologies, the Aseptic Sampling Market is likely to witness a transformation in how sampling is conducted, leading to improved outcomes in various applications.