Aging Population

The aging population is a critical driver of growth within the artificial limb Market. As life expectancy increases, the prevalence of age-related conditions such as diabetes and vascular diseases, which often lead to limb loss, is also rising. Current estimates indicate that by 2030, the number of individuals aged 65 and older will surpass 1 billion, significantly impacting the demand for prosthetic limbs. This demographic shift necessitates the development of specialized products that cater to the unique needs of older adults, including lightweight designs and enhanced functionality. Consequently, the Artificial Limb Market is likely to see a surge in innovations aimed at improving mobility and independence for the elderly, thereby expanding market opportunities.

Technological Advancements

The Artificial Limb Market is experiencing a transformative phase due to rapid technological advancements. Innovations such as 3D printing, robotics, and artificial intelligence are revolutionizing the design and functionality of prosthetic limbs. For instance, the integration of smart sensors allows for real-time adjustments, enhancing user experience and mobility. According to recent data, the market for advanced prosthetics is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years. This growth is driven by the increasing adoption of these technologies, which not only improve the quality of life for amputees but also reduce the overall cost of limb production. As a result, the Artificial Limb Market is likely to witness a surge in demand for high-tech prosthetics that offer greater adaptability and user-friendliness.

Increased Awareness and Advocacy

Increased awareness and advocacy surrounding disability rights and rehabilitation are significantly influencing the Artificial Limb Market. Organizations and campaigns aimed at promoting inclusivity and accessibility are raising public consciousness about the needs of amputees. This heightened awareness is leading to greater acceptance of prosthetic use and encouraging individuals to seek out artificial limbs. Recent studies indicate that awareness campaigns have resulted in a 25% increase in inquiries about prosthetic options among potential users. Furthermore, as more individuals advocate for their rights, there is a growing push for improved healthcare policies and funding for prosthetic devices. This trend is likely to bolster the Artificial Limb Market, as increased demand for prosthetics aligns with the ongoing efforts to enhance the quality of life for those with limb loss.

Customization and Personalization

Customization and personalization are becoming pivotal trends within the Artificial Limb Market. Consumers increasingly seek prosthetic solutions tailored to their specific needs, preferences, and lifestyles. This demand for individualized products is prompting manufacturers to invest in customizable designs that cater to various aesthetic and functional requirements. Recent surveys indicate that nearly 60% of users prefer prosthetics that reflect their personal style, which has led to a rise in options for colors, materials, and features. Furthermore, the ability to personalize prosthetics not only enhances user satisfaction but also fosters a sense of ownership and identity among users. As a result, the Artificial Limb Market is likely to expand as companies innovate to meet these diverse consumer demands, potentially increasing market share and profitability.

Rising Demand in Emerging Markets

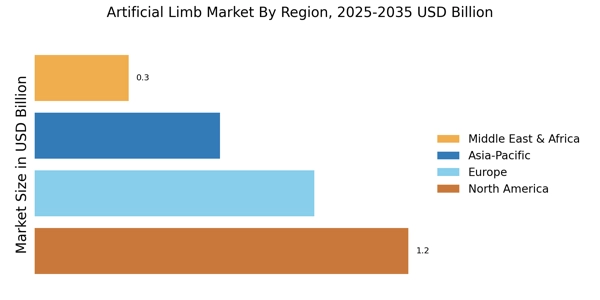

The Artificial Limb Market is witnessing a notable increase in demand from emerging markets, where healthcare infrastructure is rapidly evolving. Countries in Asia and Africa are experiencing a surge in the number of amputees due to various factors, including accidents and diseases. This demographic shift is driving the need for affordable and accessible prosthetic solutions. Market analysis suggests that the demand for artificial limbs in these regions could grow by over 10% annually, as governments and NGOs work to improve healthcare access. Additionally, the introduction of cost-effective manufacturing techniques is enabling local production of prosthetics, further stimulating market growth. As a result, the Artificial Limb Market is poised for expansion, with significant opportunities arising from these emerging economies.