Regulatory Support

Regulatory frameworks promoting the use of synthetic materials are emerging as a key driver for the artificial leather product Market. Governments are increasingly implementing policies that encourage the adoption of sustainable and cruelty-free alternatives to traditional leather. These regulations not only support environmental sustainability but also align with changing consumer attitudes towards animal welfare. In 2025, the market is likely to benefit from favorable regulations that incentivize manufacturers to invest in artificial leather production. This regulatory support may lead to increased market penetration and consumer acceptance, further propelling the growth of the Artificial Leather Product Market as stakeholders adapt to evolving legal landscapes.

Diverse Application Areas

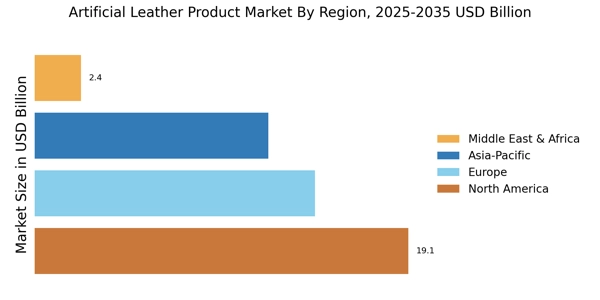

The versatility of artificial leather is a significant driver for the Artificial Leather Product Market. This material is increasingly being utilized across a wide range of sectors, including fashion, automotive, and home furnishings. In 2025, the automotive segment is anticipated to account for a considerable share of the market, driven by the demand for lightweight and durable materials that enhance vehicle aesthetics. Additionally, the fashion industry is embracing artificial leather for its ability to offer stylish options without compromising on ethical considerations. The expansion of application areas suggests that the Artificial Leather Product Market is poised for growth, as manufacturers explore new uses and innovations that cater to diverse consumer preferences.

Technological Innovations

Technological advancements are reshaping the landscape of the Artificial Leather Product Market. Innovations in manufacturing processes, such as 3D printing and advanced polymer technologies, are enhancing the quality and versatility of artificial leather. These technologies enable the production of materials that closely mimic the texture and appearance of genuine leather while offering superior durability and resistance to wear. In 2025, the market is expected to benefit from these advancements, with a projected increase in the adoption of high-performance artificial leather across various sectors, including fashion, automotive, and furniture. The integration of smart technologies, such as embedded sensors, may further expand the applications of artificial leather, making it a compelling choice for manufacturers and consumers alike.

Sustainability Initiatives

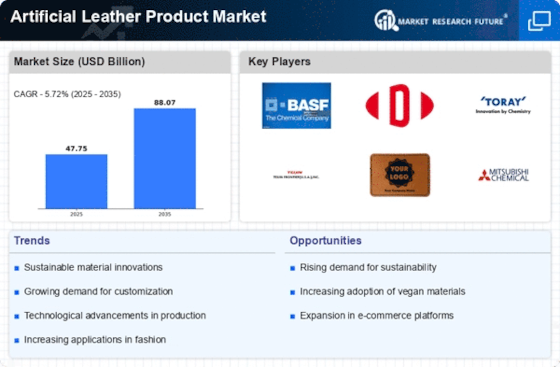

The increasing emphasis on sustainability appears to be a pivotal driver for the Artificial Leather Product Market. Consumers are becoming more environmentally conscious, leading to a rising demand for eco-friendly alternatives to traditional leather. This shift is reflected in the market, where the production of artificial leather, often derived from recycled materials, is gaining traction. In 2025, the market for sustainable artificial leather is projected to reach substantial figures, indicating a robust growth trajectory. Companies are investing in innovative production techniques that minimize environmental impact, thus aligning with consumer preferences. As a result, the Artificial Leather Product Market is likely to witness a surge in demand for products that not only meet aesthetic and functional needs but also adhere to sustainability standards.

Consumer Awareness and Preferences

The growing awareness among consumers regarding the ethical implications of leather production is influencing the Artificial Leather Product Market. As consumers become more informed about the environmental and ethical concerns associated with traditional leather, there is a noticeable shift towards artificial alternatives. In 2025, this trend is expected to continue, with a significant portion of the market driven by consumers seeking cruelty-free and sustainable options. Brands that prioritize transparency and ethical sourcing are likely to gain a competitive edge, thereby fostering growth within the Artificial Leather Product Market. This shift in consumer preferences suggests a long-term trend that could reshape market dynamics and encourage innovation in product offerings.