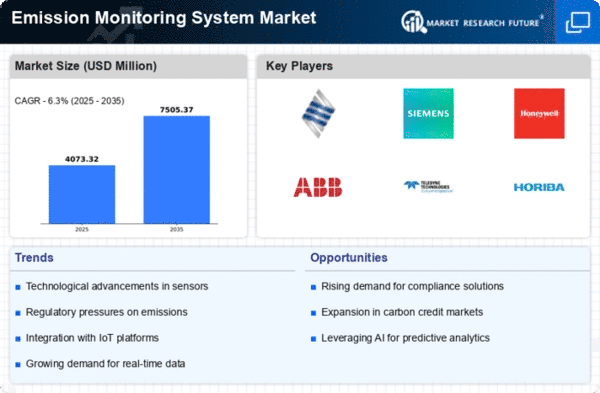

Market Growth Projections

The Global Emission Monitoring System Market (EMS) Market Industry is projected to experience substantial growth over the next decade. With a market valuation of 3.83 USD Billion in 2024, it is anticipated to reach 7.5 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 6.31% from 2025 to 2035. The increasing focus on environmental sustainability, coupled with advancements in monitoring technologies, is likely to drive this expansion. As industries and governments prioritize emissions reduction, the demand for effective EMS solutions will continue to rise.

Technological Advancements

Technological innovations are significantly shaping the Global Emission Monitoring System Market (EMS) Market Industry. The integration of IoT, AI, and machine learning into EMS solutions enhances data accuracy and real-time monitoring capabilities. These advancements allow for predictive analytics, which can forecast emissions trends and optimize operational efficiency. For example, smart sensors can detect emissions in real-time, providing organizations with actionable insights. As a result, the market is expected to grow at a CAGR of 6.31% from 2025 to 2035, reflecting the increasing reliance on technology to meet environmental goals.

Investment in Renewable Energy

The transition towards renewable energy sources is significantly impacting the Global Emission Monitoring System Market (EMS) Market Industry. Governments and organizations are increasingly investing in renewable energy projects, which require robust monitoring systems to track emissions reductions. For instance, solar and wind energy projects necessitate accurate emissions data to validate their environmental benefits. This investment trend is expected to drive the EMS market, as stakeholders seek to ensure compliance with emissions targets and enhance the credibility of renewable energy initiatives.

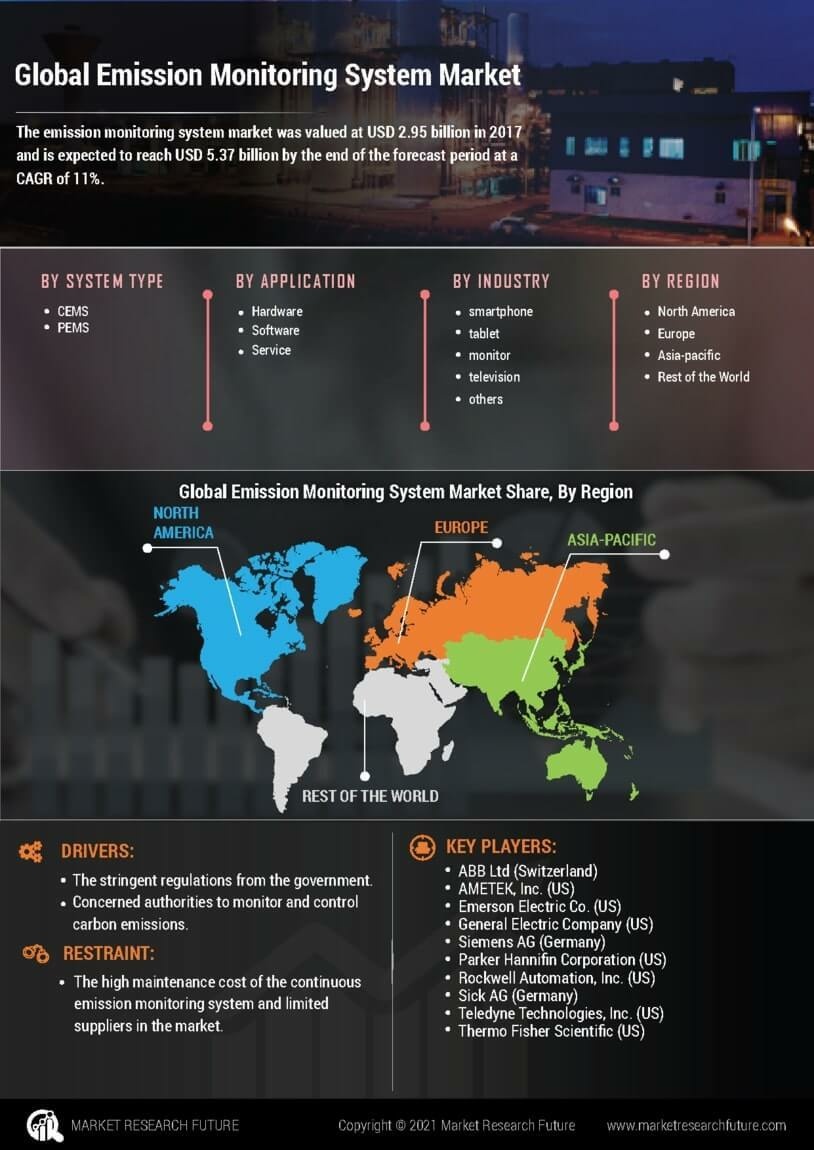

Regulatory Compliance Pressure

The Global Emission Monitoring System Market (EMS) Market Industry is experiencing heightened pressure from regulatory bodies to comply with stringent environmental standards. Governments worldwide are implementing stricter emissions regulations, which necessitate accurate monitoring and reporting of greenhouse gas emissions. For instance, the European Union's Emission Trading System mandates that companies monitor their emissions closely, thereby driving demand for advanced EMS solutions. This regulatory landscape is projected to propel the market to a valuation of 3.83 USD Billion in 2024, as organizations invest in technologies that ensure compliance and mitigate penalties.

Growing Environmental Awareness

There is a marked increase in global environmental awareness, which is influencing the Global Emission Monitoring System Market (EMS) Market Industry. Consumers and stakeholders are increasingly demanding transparency regarding corporate emissions. This shift is prompting businesses to adopt EMS solutions to demonstrate their commitment to sustainability. For instance, companies are now publicly disclosing their emissions data, which necessitates reliable monitoring systems. This trend is likely to contribute to the market's growth, with projections indicating a rise to 7.5 USD Billion by 2035 as organizations prioritize environmental responsibility.

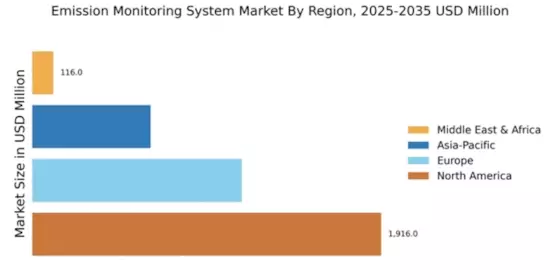

Industrial Growth and Urbanization

Rapid industrial growth and urbanization are key drivers of the Global Emission Monitoring System Market (EMS) Market Industry. As industries expand and urban areas develop, emissions from manufacturing, transportation, and energy sectors are on the rise. This increase necessitates effective monitoring systems to manage and mitigate emissions. For example, emerging economies are witnessing a surge in industrial activities, leading to a greater demand for EMS solutions. Consequently, the market is poised for substantial growth as industries seek to balance economic development with environmental sustainability.