Market Trends

Key Emerging Trends in the Artificial Intelligence (AI) in manufacturing Market

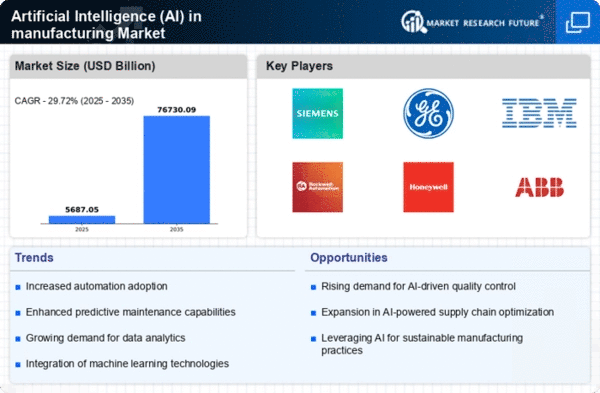

The market trends in Artificial Intelligence (AI) within the manufacturing sector reflect a transformative shift towards greater efficiency, flexibility, and innovation. One prevailing trend is the increased adoption of predictive maintenance powered by AI. Manufacturers are leveraging machine learning algorithms to analyze data from sensors and equipment, enabling them to predict potential breakdowns and schedule maintenance activities proactively. This trend not only minimizes unplanned downtime but also optimizes equipment performance, reducing overall operational costs for manufacturing facilities.

Industry 4.0 is a significant trend shaping the AI landscape in manufacturing. The integration of AI into smart factories, characterized by interconnected systems and real-time data analytics, is gaining momentum. Manufacturers are deploying AI technologies to create intelligent and adaptive production environments, facilitating data-driven decision-making and automation of complex processes. This trend reflects the industry's commitment to embracing the next phase of industrial evolution, marked by the convergence of digital technologies and physical manufacturing processes.

Customization and flexibility have become key trends in manufacturing, driven by consumer demands for personalized products. AI is playing a pivotal role in enabling agile and adaptive manufacturing processes that can quickly respond to changing customer preferences. Manufacturers are implementing AI-driven solutions to customize production lines, allowing for efficient shifts between different product configurations. This trend reflects the industry's focus on meeting consumer expectations for tailor-made products in an increasingly competitive market.

Supply chain optimization is another notable trend fueled by AI in manufacturing. Manufacturers are leveraging AI algorithms for demand forecasting, inventory management, and logistics optimization. By analyzing vast datasets in real-time, AI enables manufacturers to make more accurate predictions and optimize supply chain processes. This trend addresses the challenges of global supply chain complexities, enhancing responsiveness to market fluctuations and improving overall operational efficiency.

Collaborative robots, or cobots, are increasingly becoming a trend in the manufacturing sector. These robots work alongside human workers, enhancing efficiency and safety in various manufacturing tasks. AI integration allows cobots to adapt to changing production requirements, collaborate seamlessly with human workers, and contribute to increased productivity. The trend emphasizes a harmonious coexistence of human and machine capabilities on the manufacturing floor, fostering a collaborative and innovative work environment.

Quality control and defect detection are witnessing advancements through AI-driven technologies. Machine vision systems equipped with AI algorithms enable real-time inspection and identification of defects in products. Manufacturers are adopting AI-driven quality control to enhance product quality, reduce waste, and ensure compliance with industry standards. This trend reflects the industry's commitment to achieving higher levels of precision and quality assurance through AI technologies, ultimately leading to improved customer satisfaction.

Data security and privacy considerations are emerging as critical trends in the AI in manufacturing market. As manufacturers accumulate and analyze vast amounts of sensitive data for AI-driven insights, securing this information becomes paramount. The trend involves implementing robust cybersecurity measures, ensuring compliance with data protection regulations, and fostering a culture of responsible data handling. This reflects the industry's acknowledgment of the importance of safeguarding sensitive information in the age of AI-driven manufacturing.

The convergence of AI with other emerging technologies, such as the Internet of Things (IoT) and edge computing, is a trend reshaping manufacturing processes. AI is utilized to analyze data generated by interconnected devices, enabling real-time decision-making at the edge of the network. This trend enhances the efficiency of data processing, reduces latency, and supports the seamless integration of AI into various manufacturing applications.

Leave a Comment