Market Analysis

In-depth Analysis of Artificial Intelligence (AI) in manufacturing Market Industry Landscape

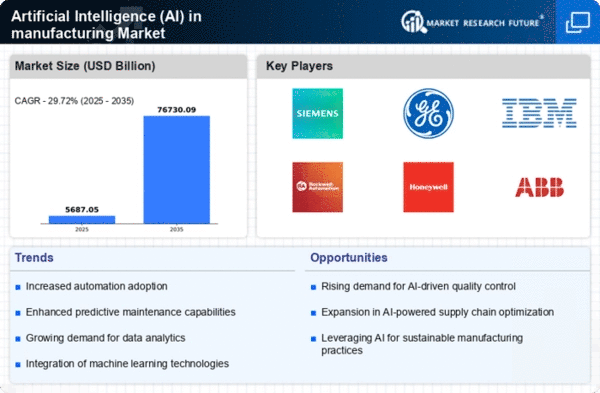

The market dynamics of Artificial Intelligence (AI) in the manufacturing sector are experiencing transformative shifts, redefining how industries approach production processes and efficiency. A significant dynamic is the integration of AI-driven technologies to enhance operational efficiency and optimize production workflows. Manufacturers are leveraging AI for predictive maintenance, quality control, and demand forecasting, allowing for proactive decision-making and minimizing downtime. This dynamic reflects the industry's recognition of AI as a pivotal tool for achieving operational excellence and ensuring a competitive edge in the rapidly evolving manufacturing landscape.

Another notable dynamic in the AI in manufacturing market is the emergence of smart factories. AI technologies, including machine learning and robotics, are instrumental in creating intelligent and interconnected manufacturing environments. Smart factories leverage AI to enable real-time data analysis, predictive analytics, and adaptive manufacturing processes. This dynamic marks a paradigm shift towards Industry 4.0, where AI plays a central role in transforming traditional manufacturing facilities into agile, data-driven, and interconnected ecosystems.

The customization trend is influencing the dynamics of AI adoption in manufacturing. As consumer demands for personalized and customized products rise, manufacturers are turning to AI-driven solutions to accommodate these preferences efficiently. AI enables adaptive manufacturing processes that can quickly reconfigure production lines to meet changing demands. This dynamic reflects the industry's responsiveness to evolving consumer expectations and the need for agile manufacturing systems.

Supply chain optimization is a key dynamic driven by AI in the manufacturing sector. Manufacturers are increasingly relying on AI algorithms for demand forecasting, inventory management, and logistics optimization. AI enables real-time analysis of vast datasets, allowing for more accurate predictions and agile responses to supply chain disruptions. This dynamic reflects the industry's commitment to creating resilient and responsive supply chains, especially in the face of global uncertainties and market fluctuations.

Collaborative robots, or cobots, are shaping the dynamics of AI adoption on the manufacturing floor. These robots work alongside human workers, enhancing efficiency and safety in various manufacturing tasks. The integration of AI allows cobots to adapt to changing production requirements, collaborate seamlessly with human workers, and contribute to increased productivity. This dynamic represents a collaborative and synergistic approach to leveraging AI technologies in manufacturing, emphasizing the coexistence of human and machine capabilities.

AI is also influencing quality control and defect detection in manufacturing processes. Advanced machine vision systems, powered by AI algorithms, enable real-time inspection and identification of defects in products. Manufacturers leverage AI-driven quality control to enhance product quality, reduce waste, and ensure compliance with industry standards. This dynamic reflects the industry's commitment to achieving higher levels of precision and quality assurance through AI technologies.

Data security and privacy considerations are becoming increasingly important dynamics in the AI in manufacturing market. As manufacturers accumulate vast amounts of sensitive data for AI-driven analysis, ensuring the security and privacy of this information becomes paramount. Manufacturers are investing in robust cybersecurity measures and compliance frameworks to address these concerns. This dynamic underscores the industry's recognition of the importance of securing data in the age of AI-driven manufacturing.

The talent gap is a notable challenge influencing the dynamics of AI adoption in manufacturing. While the demand for AI expertise in manufacturing is growing, there is a shortage of skilled professionals with the necessary knowledge. Manufacturers are addressing this challenge through training programs, collaborations with educational institutions, and strategic partnerships with AI solution providers. This dynamic highlights the industry's proactive efforts to bridge the talent gap and cultivate a workforce capable of harnessing the full potential of AI technologies.

Leave a Comment