Rising Fuel Prices

The escalating prices of fossil fuels in Argentina are driving consumers and businesses to seek alternative energy solutions. As fuel costs rise, the electric vehicles-battery market gains traction, as electric vehicles (EVs) present a more economical option in the long run. The cost of gasoline has seen fluctuations, with recent averages around $1.20 per liter, prompting a shift in consumer behavior. This economic pressure encourages investment in electric vehicles, which are perceived as a sustainable and cost-effective alternative. Consequently, the demand for batteries, which are essential for EV operation, is likely to increase. The electric vehicles-battery market is thus positioned to benefit from this trend, as consumers look for ways to mitigate their transportation costs while contributing to environmental sustainability.

Environmental Regulations

Stringent environmental regulations in Argentina are compelling manufacturers and consumers to consider electric vehicles as a viable alternative to traditional combustion engines. The government has implemented policies aimed at reducing greenhouse gas emissions, which are expected to decrease by 30% by 2030. These regulations create a favorable environment for the electric vehicles-battery market, as they encourage the adoption of cleaner technologies. As a result, automakers are increasingly investing in electric vehicle production, which in turn drives demand for batteries. The electric vehicles-battery market is likely to see growth as compliance with these regulations becomes a priority for both manufacturers and consumers, fostering a shift towards sustainable transportation solutions.

Infrastructure Development

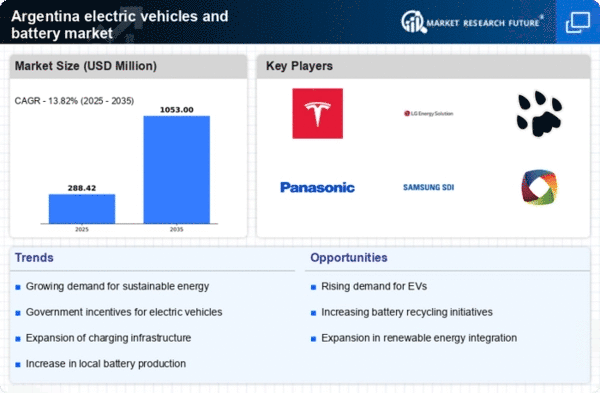

The expansion of charging infrastructure across Argentina is a critical driver for the electric vehicles-battery market. As more charging stations become available, the convenience of owning an electric vehicle increases, alleviating range anxiety among potential buyers. Recent initiatives have seen the installation of over 1,000 public charging points, which is expected to grow by 50% in the next two years. This development not only supports the existing electric vehicle owners but also attracts new consumers to the market. The electric vehicles-battery market stands to benefit from this infrastructure growth, as it enhances the overall viability of electric vehicles, making them a more attractive option for everyday use.

Technological Advancements

Innovations in battery technology are significantly impacting the electric vehicles-battery market. Developments in lithium-ion batteries, solid-state batteries, and fast-charging technologies are enhancing the performance and efficiency of electric vehicles. For instance, advancements have led to batteries with energy densities exceeding 250 Wh/kg, which could potentially extend the range of EVs and reduce charging times. These improvements not only make electric vehicles more appealing to consumers but also stimulate investment in the electric vehicles-battery market. As manufacturers adopt these technologies, the overall cost of production may decrease, making electric vehicles more accessible to a broader audience in Argentina. This trend suggests a promising future for the electric vehicles-battery market as it adapts to evolving consumer expectations and technological capabilities.

Consumer Demand for Sustainability

There is a growing consumer demand for sustainable transportation options in Argentina, which is significantly influencing the electric vehicles-battery market. As awareness of climate change and environmental issues increases, consumers are more inclined to choose electric vehicles over traditional vehicles. Surveys indicate that approximately 70% of potential car buyers express interest in electric vehicles, citing environmental concerns as a primary motivation. This shift in consumer preferences is prompting manufacturers to expand their electric vehicle offerings, thereby increasing the demand for batteries. The electric vehicles-battery market is likely to experience robust growth as it aligns with the evolving values of consumers who prioritize sustainability in their purchasing decisions.