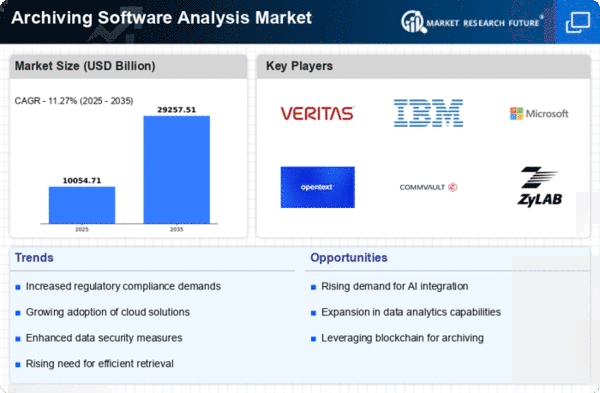

The Archiving Software Analysis Market is characterized by a dynamic competitive landscape, driven by the increasing need for data management and compliance across various industries. Key players such as Veritas Technologies LLC (US), IBM Corporation (US), and Microsoft Corporation (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Veritas Technologies LLC (US) focuses on innovation through continuous product development, particularly in cloud-based archiving solutions, which aligns with the growing trend of digital transformation. Meanwhile, IBM Corporation (US) emphasizes strategic partnerships and acquisitions to bolster its capabilities in data governance and compliance, thereby enhancing its service offerings. Microsoft Corporation (US) leverages its extensive ecosystem to integrate archiving solutions seamlessly with its existing cloud services, thus appealing to a broad customer base. Collectively, these strategies contribute to a competitive environment that is increasingly centered around technological advancement and customer-centric solutions.In terms of business tactics, companies are increasingly localizing their operations to better serve regional markets, optimizing supply chains to enhance efficiency and responsiveness. The competitive structure of the market appears moderately fragmented, with several key players exerting influence while also facing competition from emerging firms. This fragmentation allows for a diverse range of solutions, catering to various customer needs and preferences, which in turn fosters innovation and competitive pricing.

In November Veritas Technologies LLC (US) announced a strategic partnership with a leading cloud service provider to enhance its archiving capabilities. This collaboration is expected to facilitate the integration of advanced analytics into their archiving solutions, thereby providing clients with deeper insights into their data management practices. Such a move not only strengthens Veritas's market position but also reflects a broader trend towards data-driven decision-making in archiving practices.

In October IBM Corporation (US) completed the acquisition of a prominent data compliance firm, which is anticipated to significantly enhance its portfolio of archiving solutions. This acquisition underscores IBM's commitment to expanding its capabilities in regulatory compliance, a critical area for many organizations. By integrating these new technologies, IBM aims to offer more robust solutions that address the evolving needs of its clients in a complex regulatory landscape.

In September Microsoft Corporation (US) launched an innovative feature within its archiving software that utilizes AI to automate data classification and retention policies. This development is likely to streamline operations for businesses, reducing the manual effort required in data management. The integration of AI not only enhances efficiency but also positions Microsoft as a leader in leveraging cutting-edge technology to meet customer demands.

As of December the Archiving Software Analysis Market is witnessing trends that emphasize digitalization, sustainability, and AI integration. Strategic alliances among key players are shaping the competitive landscape, fostering innovation and collaboration. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future differentiation will hinge on the ability to innovate and adapt to changing market demands. Companies that prioritize these aspects are likely to thrive in an increasingly competitive environment.