Rising Demand for Seafood

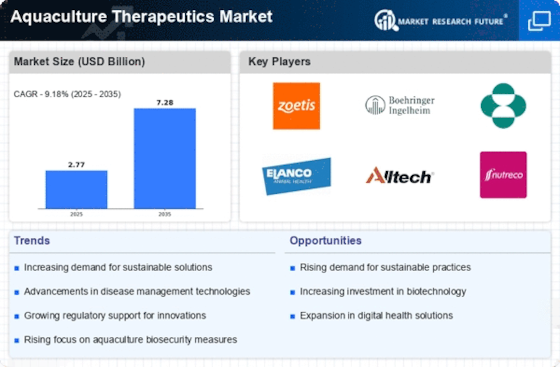

The increasing The Aquaculture Therapeutics Industry. As consumers become more health-conscious, the preference for protein-rich diets, particularly seafood, has surged. Reports indicate that seafood consumption is projected to reach 200 million tons by 2030, necessitating enhanced aquaculture practices. This demand compels aquaculture producers to invest in therapeutics to ensure the health and productivity of aquatic species. Consequently, the need for effective disease management solutions becomes paramount, thereby propelling the growth of the Aquaculture Therapeutics Market.

Emergence of Aquaculture Diseases

The proliferation of diseases affecting aquaculture species is a critical concern that drives the Aquaculture Therapeutics Market. Pathogens such as bacteria, viruses, and parasites pose significant threats to fish and shellfish populations, leading to substantial economic losses. For instance, the economic impact of diseases in aquaculture is estimated to reach billions annually. This alarming trend necessitates the development and application of therapeutics to manage and mitigate disease outbreaks. As aquaculture operations expand, the demand for innovative treatment solutions is likely to increase, further stimulating the growth of the Aquaculture Therapeutics Market.

Regulatory Support and Compliance

Regulatory frameworks governing aquaculture practices are increasingly supportive of the Aquaculture Therapeutics Market. Governments and international bodies are establishing guidelines to ensure the safe use of therapeutics in aquaculture. Compliance with these regulations is essential for market access and sustainability. The implementation of stringent safety standards encourages the development of innovative therapeutic solutions that align with environmental and health considerations. As regulatory bodies continue to evolve their policies, the Aquaculture Therapeutics Market is likely to benefit from enhanced credibility and consumer trust, fostering market growth.

Technological Innovations in Therapeutics

Technological advancements in therapeutics are transforming the Aquaculture Therapeutics Market. Innovations such as vaccines, probiotics, and nutraceuticals are being developed to enhance fish health and growth. The integration of biotechnology in aquaculture has led to the creation of more effective and environmentally friendly therapeutic options. For example, the use of genetically modified organisms in vaccine development has shown promise in combating specific diseases. As these technologies continue to evolve, they are expected to play a crucial role in addressing the challenges faced by aquaculture producers, thereby driving the Aquaculture Therapeutics Market forward.

Focus on Sustainable Aquaculture Practices

The growing emphasis on sustainability within the aquaculture sector is a significant driver of the Aquaculture Therapeutics Market. Consumers and stakeholders are increasingly advocating for environmentally responsible practices that minimize ecological impact. This shift has prompted aquaculture producers to adopt sustainable methods, including the use of therapeutics that are less harmful to aquatic ecosystems. The market for organic and eco-friendly therapeutics is expanding, reflecting consumer preferences for sustainably sourced seafood. As sustainability becomes a core principle in aquaculture, the demand for innovative therapeutic solutions that align with these values is expected to rise, further propelling the Aquaculture Therapeutics Market.