Rising Demand for Seafood

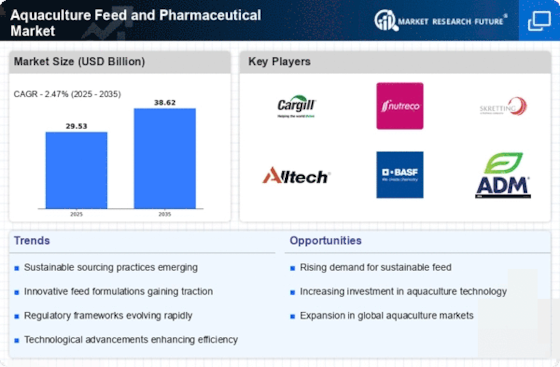

The increasing The Aquaculture Feed and Pharmaceutical Industry. As populations grow and dietary preferences shift towards protein-rich foods, aquaculture is positioned to meet this demand. According to recent data, seafood consumption has risen significantly, with projections indicating a continued upward trend. This surge necessitates the development of efficient aquaculture feed solutions to ensure sustainable production. Consequently, the Aquaculture Feed and Pharmaceutical Market is likely to experience growth as producers seek innovative feed formulations that enhance growth rates and feed conversion efficiency. The need for high-quality feed is further emphasized by the rising consumer awareness regarding the nutritional value of seafood, which in turn drives investments in aquaculture feed technologies.

Advancements in Nutritional Science

Advancements in nutritional science are reshaping the Aquaculture Feed and Pharmaceutical Market. Research into the dietary needs of various aquaculture species has led to the development of specialized feed formulations that optimize growth and health. For example, the incorporation of functional ingredients such as probiotics and prebiotics is becoming more prevalent, enhancing the overall health of aquatic species. This trend is supported by data indicating that well-formulated feeds can significantly improve feed conversion ratios and reduce disease incidence. As aquaculture producers increasingly recognize the importance of nutrition in fish health and productivity, the demand for innovative feed solutions within the Aquaculture Feed and Pharmaceutical Market is expected to rise, fostering further research and development.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainable aquaculture practices are increasingly influencing the Aquaculture Feed and Pharmaceutical Market. Governments and international organizations are implementing policies aimed at reducing environmental impacts associated with aquaculture. These regulations often encourage the use of sustainable feed ingredients and responsible farming practices. For instance, initiatives that support the reduction of fishmeal usage in feed formulations are gaining traction. This shift not only aligns with environmental goals but also opens avenues for innovation within the Aquaculture Feed and Pharmaceutical Market. Companies that adapt to these regulations may find themselves at a competitive advantage, as they can offer products that meet both regulatory standards and consumer expectations for sustainability.

Technological Innovations in Feed Production

Technological innovations in feed production are driving transformation within the Aquaculture Feed and Pharmaceutical Market. The integration of automation, artificial intelligence, and data analytics into feed manufacturing processes is enhancing efficiency and product quality. These technologies enable producers to optimize feed formulations based on real-time data, ensuring that nutritional requirements are met with precision. Moreover, advancements in processing techniques, such as extrusion and pelleting, are improving the digestibility and palatability of aquaculture feeds. As these technologies become more accessible, they are likely to attract investments and foster competition within the Aquaculture Feed and Pharmaceutical Market, ultimately benefiting producers and consumers alike.

Growing Awareness of Aquaculture Health Management

The growing awareness of health management in aquaculture is a significant driver for the Aquaculture Feed and Pharmaceutical Market. As disease outbreaks can severely impact production, aquaculture producers are increasingly prioritizing health management strategies. This includes the use of pharmaceuticals and nutraceuticals designed to enhance fish health and resilience. Data suggests that the market for aquaculture pharmaceuticals is expanding, driven by the need for effective disease control measures. Furthermore, the integration of health management practices into feed formulations is becoming more common, as producers seek to improve the overall health of their stock. This trend indicates a shift towards a more holistic approach in the Aquaculture Feed and Pharmaceutical Market, where health management is viewed as integral to sustainable production.