Top Industry Leaders in the Application Container Market

Containerizing the Future: A Deep Dive into the Application Container Market

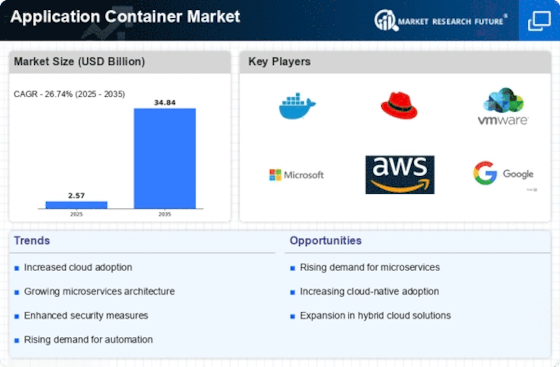

The application container market, fueled by the need for agility and efficiency in the digital age, is expected to grow at a CAGR over the next five years, reaching a staggering USD billion value by 2029. This dynamic landscape is populated by established giants, nimble startups, and a mix of strategies, all vying for a piece of the containerization pie.

Key Players:

- IBM Corporation (US)

- AWS Inc. (US)

- Microsoft Corporation (US)

- Google LLC (US)

- VMware Inc. (US)

- Oracle Corporation (US)

- Apprenda Inc. (US)

- Joyent Inc. (US)

- Mesosphere, Inc. (US)

- Weaveworks (UK)

- Red Hat, Inc.

- Cisco Systems, Inc

Strategies Fueling the Battleground:

-

Hybrid and Multi-Cloud Focus: As organizations embrace hybrid and multi-cloud environments, vendors are prioritizing solutions that support portability and seamless application management across disparate cloud platforms.

-

Security and Compliance First: Container security continues to be a top concern, driving demand for integrated security solutions, vulnerability scanning, and compliance tools for regulated industries.

-

Automation and Developer Experience: Streamlining workflows and automating container deployments and management is key to attracting developers and enterprises. Companies are investing in user-friendly tools and automated pipelines.

-

Edge Computing Expansion: Container technology is increasingly used at the edge, close to data sources, driving innovations in smaller form-factor container runtimes and edge-specific management platforms.

Factors Dictating Market Share:

-

Solution Completeness: Vendors offering a comprehensive suite of container tools, from orchestration to security and developer tools, will hold a competitive edge.

-

Cloud Ecosystem Integration: Seamless integration with popular cloud platforms and strong partnerships with cloud providers will be crucial for adoption.

-

Open-Source Advocacy: Commitment to open-source technologies and active participation in open-source communities builds trust and fosters wider adoption.

-

Vertical Specialization: Understanding and catering to the specific needs of different industries, such as healthcare or finance, can unlock growth opportunities.

Fresh Blood: New and Emerging Players:

Startups like Platform9, StackRox, and Sysdig are injecting exciting ideas with innovative solutions like Kubernetes security platforms, container vulnerability management tools, and cloud-native application performance monitoring. These new entrants challenge established players by addressing specific pain points and offering agile, modern solutions.

Investment Trends Steering the Future:

-

Infrastructure as Code: Continuous integration and continuous delivery (CI/CD) pipelines and infrastructure as code (IaC) are accelerating container adoption. Companies are investing in tools and platforms that automate container deployments and management.

-

Serverless Integration: Serverless computing and containers are converging, offering new approaches to application development and deployment. Startups and established players are exploring and investing in this fusion space.

-

Security at the Forefront: Security vulnerabilities and breaches in containerized environments remain a concern. Companies are pouring resources into developing robust security solutions and building trust in containerized applications.

-

Focus on Sustainability: Energy efficiency and resource optimization are gaining traction in the container market. Companies are developing lightweight container runtimes and promoting best practices for sustainable containerized workloads.

The application container market is not just about technological advancement; it's about empowering agility, efficiency, and innovation in the digital world. Recognizing the key players, their strategies, and the factors influencing market share is crucial for navigating this dynamic landscape. By embracing open-source, prioritizing security, and catering to evolving needs, established players and innovative newcomers can thrive in this rapidly evolving and impactful market.

Latest Company Updates:

- October 26, 2023: Docker announced the launch of Docker BuildKit, a next-generation build engine that promises faster and more efficient container image creation.

- November 10, 2023: The Cloud Native Computing Foundation (CNCF) announced the graduation of Containerd, a critical container runtime environment, to maturity, solidifying its role as a core component of the container ecosystem.

- December 07, 2023: Microsoft Azure announced the general availability of Azure Container Instances (ACI), a serverless container hosting service that simplifies container deployment and management on the Azure platform.