Stringent Regulatory Requirements

The API Contract Manufacturing Market is significantly influenced by stringent regulatory requirements imposed by health authorities. Compliance with Good Manufacturing Practices (GMP) and other regulatory standards is essential for contract manufacturers to ensure the safety and efficacy of APIs. As regulatory scrutiny intensifies, pharmaceutical companies are increasingly relying on contract manufacturers that demonstrate a strong commitment to quality and compliance. In 2025, the global market for regulatory compliance solutions in the pharmaceutical sector is projected to reach USD 15 billion. This trend underscores the importance of regulatory adherence in the API Contract Manufacturing Market, as companies that prioritize compliance are more likely to secure contracts and maintain a competitive advantage in the marketplace.

Increasing Demand for Generic Drugs

The API Contract Manufacturing Market is experiencing a notable surge in the demand for generic drugs. As patent expirations for several blockbuster medications occur, pharmaceutical companies are increasingly outsourcing the production of active pharmaceutical ingredients (APIs) to contract manufacturers. This trend is driven by the need to reduce costs and enhance efficiency. In 2025, the market for generic drugs is projected to reach approximately USD 400 billion, indicating a robust growth trajectory. Contract manufacturers are well-positioned to meet this demand, as they possess the necessary expertise and infrastructure to produce high-quality APIs at competitive prices. This shift towards generics not only benefits pharmaceutical companies but also enhances patient access to affordable medications, thereby driving the overall growth of the API Contract Manufacturing Market.

Rising Focus on Personalized Medicine

The API Contract Manufacturing Market is witnessing a shift towards personalized medicine, which is tailored to individual patient needs. This trend is fueled by advancements in genomics and biotechnology, enabling the development of targeted therapies. As pharmaceutical companies invest in research and development of personalized drugs, the demand for specialized APIs is expected to rise. In 2025, the market for personalized medicine is projected to reach USD 2 trillion, highlighting its potential impact on the pharmaceutical landscape. Contract manufacturers that can provide customized API solutions will likely gain a competitive edge, as they cater to the unique requirements of personalized therapies. This focus on individualized treatment options is anticipated to significantly influence the growth trajectory of the API Contract Manufacturing Market.

Technological Advancements in Manufacturing Processes

Technological innovations are playing a pivotal role in shaping the API Contract Manufacturing Market. The adoption of advanced manufacturing technologies, such as continuous manufacturing and process analytical technology (PAT), is enhancing production efficiency and product quality. These advancements allow for real-time monitoring and control of manufacturing processes, which can lead to reduced production times and lower costs. In 2025, it is estimated that the market for advanced manufacturing technologies in the pharmaceutical sector will exceed USD 20 billion. As contract manufacturers integrate these technologies into their operations, they are likely to attract more clients seeking reliable and efficient API production solutions. This trend underscores the importance of technological evolution in driving the growth of the API Contract Manufacturing Market.

Expansion of Pharmaceutical Companies in Emerging Markets

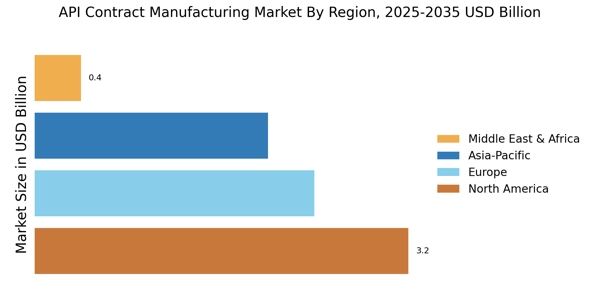

The API Contract Manufacturing Market is benefiting from the expansion of pharmaceutical companies into emerging markets. As these companies seek to tap into new customer bases and reduce operational costs, they are increasingly outsourcing API production to contract manufacturers. This trend is particularly evident in regions such as Asia-Pacific and Latin America, where manufacturing costs are lower. In 2025, the pharmaceutical market in emerging economies is expected to grow at a compound annual growth rate (CAGR) of over 10%. This expansion presents lucrative opportunities for contract manufacturers to establish partnerships with pharmaceutical firms looking to optimize their supply chains. Consequently, the growth of pharmaceutical companies in these regions is likely to drive demand for API contract manufacturing services, further propelling the API Contract Manufacturing Market.