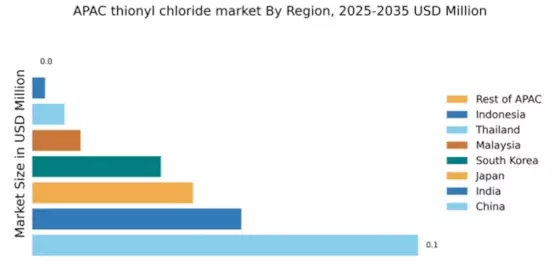

China : Robust Growth Driven by Demand

China holds a significant market share of 12% in the thionyl chloride sector, valued at approximately $1.2 billion. Key growth drivers include the booming chemical manufacturing industry, increasing demand for agrochemicals, and advancements in battery technology. Regulatory policies favoring domestic production and environmental compliance are also pivotal. Infrastructure development, particularly in industrial zones like Jiangsu and Guangdong, supports this growth trajectory.

India : Growing Demand in Diverse Sectors

Key markets include Maharashtra and Gujarat, where major chemical hubs are located. The competitive landscape features players like BASF and Hubei Gekang Chemical. Local dynamics are characterized by a mix of multinational corporations and domestic firms, fostering innovation. The pharmaceutical and agrochemical sectors are the primary consumers of thionyl chloride, driving market expansion.

Japan : Innovation Fuels Thionyl Chloride Demand

Key markets include Tokyo and Osaka, where major chemical companies are headquartered. The competitive landscape is dominated by Kanto Chemical and Merck KGaA, which leverage advanced technologies. The business environment is characterized by high-quality standards and innovation, with significant applications in electronics and pharmaceuticals.

South Korea : Growth Driven by Industrial Demand

Key markets include Seoul and Ulsan, known for their industrial activities. Major players like Eastman Chemical and local firms dominate the landscape. The competitive environment is characterized by a focus on quality and innovation, with thionyl chloride primarily used in battery production and specialty chemicals.

Malaysia : Strategic Location for Chemical Trade

Key markets include Selangor and Penang, where chemical manufacturing is concentrated. The competitive landscape features both local and international players, including BASF. The business environment is favorable, with a focus on sustainability and innovation, particularly in agrochemicals and specialty chemicals.

Thailand : Expanding Demand in Key Sectors

Key markets include Bangkok and Chonburi, where industrial activities are concentrated. The competitive landscape features both local and international players, with a focus on quality and compliance. Thionyl chloride is primarily used in agrochemical formulations and specialty chemicals, driving market growth.

Indonesia : Low Market Share, High Growth Prospects

Key markets include Jakarta and Surabaya, where industrial activities are growing. The competitive landscape is characterized by a mix of local and international players, with opportunities for new entrants. Thionyl chloride is primarily used in agrochemicals and pharmaceuticals, indicating a promising future for market expansion.

Rest of APAC : Exploring New Opportunities in Chemicals

Key markets are scattered across various countries, with potential in Vietnam and the Philippines. The competitive landscape is largely undeveloped, offering opportunities for new entrants. Thionyl chloride applications in agriculture and pharmaceuticals could drive future growth, making this region a potential focus for investment.