US Thionyl Chloride Market Summary

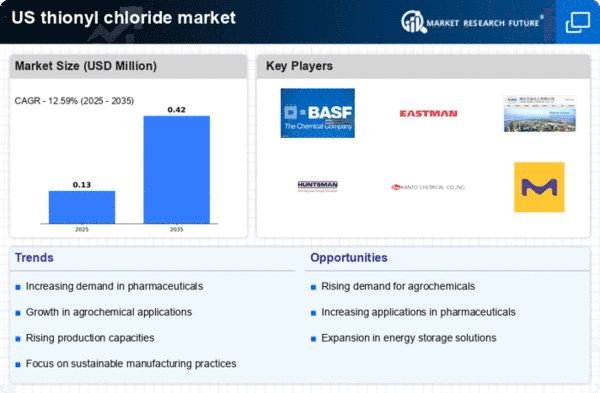

As per Market Research Future analysis, the Thionyl Chloride market size was estimated at 0.114 USD Million in 2024. The thionyl chloride market is projected to grow from 0.128 USD Million in 2025 to 0.42 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 12.5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US thionyl chloride market is poised for growth driven by sustainability and sector expansion.

- Sustainable production practices are increasingly influencing the thionyl chloride market dynamics.

- The pharmaceutical sector emerges as the largest segment, reflecting robust growth in demand for thionyl chloride.

- Technological advancements in production processes are likely to enhance efficiency and safety standards.

- Rising demand in chemical synthesis and the expansion of the agrochemical sector are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 0.114 (USD Million) |

| 2035 Market Size | 0.42 (USD Million) |

| CAGR (2025 - 2035) | 12.59% |

Major Players

BASF SE (DE), Eastman Chemical Company (US), Hubei Nanhua Chemical Co Ltd (CN), Huntsman Corporation (US), Kanto Chemical Co Inc (JP), Merck KGaA (DE), Praxair Technology Inc (US), Shandong Jinling Chemical Co Ltd (CN)