Growing Environmental Awareness

The increasing environmental awareness among consumers and stakeholders is a key driver for the APAC Sustainable Aviation Fuel Market. As public concern regarding climate change and environmental degradation intensifies, airlines are under pressure to adopt more sustainable practices. This shift in consumer preferences is prompting airlines to invest in sustainable aviation fuels as a means to enhance their corporate social responsibility profiles. In response, several major airlines in the APAC region have committed to using sustainable aviation fuels, with some aiming for 10% of their fuel supply to come from sustainable sources by 2030. This growing environmental consciousness is likely to propel the APAC Sustainable Aviation Fuel Market forward, as more airlines seek to align their operations with sustainability goals.

Investment and Funding Opportunities

Investment and funding opportunities are crucial for the growth of the APAC Sustainable Aviation Fuel Market. With the increasing recognition of the importance of sustainable aviation fuels, both public and private sectors are channeling significant investments into research and development, production facilities, and infrastructure. Governments in the region are also providing financial incentives and grants to support the development of sustainable aviation fuel projects. For instance, the Japanese government has announced funding initiatives aimed at boosting the production of sustainable aviation fuels, which is expected to attract private investments. This influx of capital is likely to accelerate the commercialization of sustainable aviation fuels, thereby enhancing the overall growth trajectory of the APAC Sustainable Aviation Fuel Market.

Collaborative Efforts Among Stakeholders

Collaborative efforts among stakeholders are emerging as a vital driver for the APAC Sustainable Aviation Fuel Market. Airlines, fuel producers, and government agencies are increasingly forming partnerships to facilitate the development and deployment of sustainable aviation fuels. These collaborations often focus on sharing knowledge, resources, and technology to overcome the challenges associated with sustainable fuel production and distribution. For example, several airlines in the APAC region have joined forces with biofuel producers to establish supply chains for sustainable aviation fuels. Such partnerships not only enhance the availability of sustainable fuels but also contribute to the overall growth of the APAC Sustainable Aviation Fuel Market by fostering innovation and reducing costs associated with fuel production.

Regulatory Support and Policy Frameworks

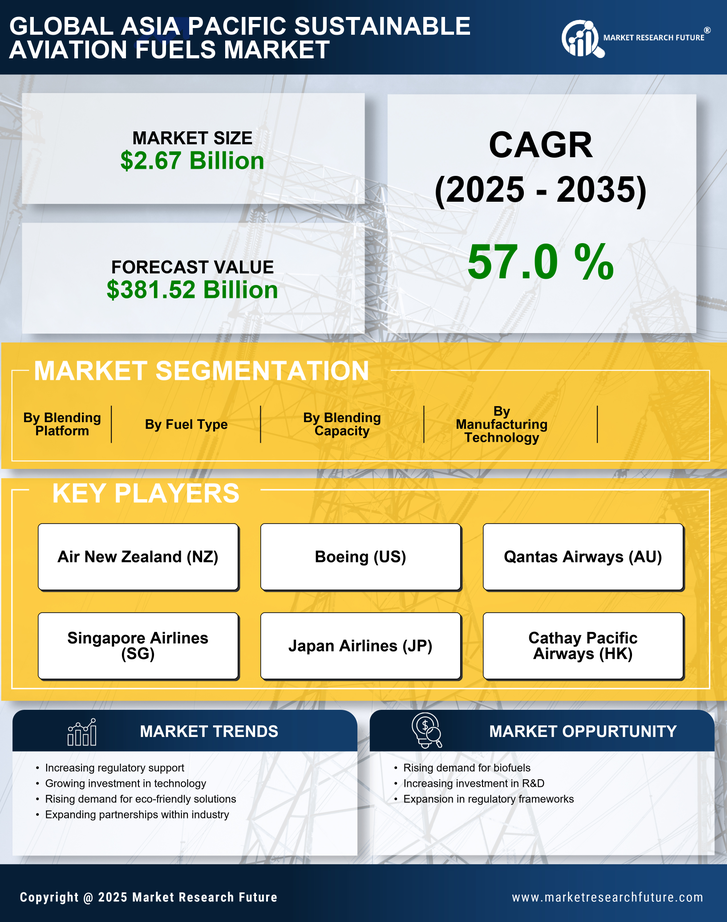

The APAC Sustainable Aviation Fuel Market is experiencing a surge in regulatory support and policy frameworks aimed at promoting the adoption of sustainable aviation fuels. Governments across the region are implementing stringent emissions reduction targets, which necessitate the transition to greener fuel alternatives. For instance, the Civil Aviation Administration of China has set ambitious goals for carbon neutrality by 2060, which includes the integration of sustainable aviation fuels into the aviation sector. This regulatory environment not only incentivizes investments in sustainable fuel technologies but also fosters innovation within the industry. As a result, the APAC Sustainable Aviation Fuel Market is likely to witness increased production capacities and a broader acceptance of sustainable fuels among airlines, thereby enhancing market growth.

Technological Innovations in Fuel Production

Technological advancements play a pivotal role in shaping the APAC Sustainable Aviation Fuel Market. Innovations in fuel production processes, such as the development of advanced biofuels and synthetic fuels, are enhancing the efficiency and sustainability of aviation fuels. For example, the use of waste feedstocks and carbon capture technologies is becoming more prevalent, allowing for the production of sustainable aviation fuels with lower lifecycle emissions. According to recent estimates, the production capacity of sustainable aviation fuels in the APAC region is projected to reach 3 million metric tons by 2030, driven by these technological innovations. Consequently, the APAC Sustainable Aviation Fuel Market is poised for significant growth as airlines increasingly adopt these advanced fuel options to meet regulatory requirements and consumer demand for greener travel.